374Water (SCWO): Delays, Delays, Delays and an Update From Down Under

In late June, we exposed numerous issues at 374Water (SCWO). Since then, the stock has fallen a bit, but we still see tremendous downside. In fact, the completion date of their installation for its first commercial unit has been delayed by a year… and at the most recent Orange County Sanitation (“OCSan”) meeting, we think they sounded pretty ambivalent about the chances of success for this Supercritical Water Oxidation project.

We won’t dive back into every point we hashed out in the first report, but since our report, several vital pieces of information have come out that we think are worth highlighting. We believe these pieces of information validate parts of our thesis and further serve our belief that this stock will be in trouble over the next 18 months. The stock has plunged to 52-week lows, and we think it will find fresh lows as there is simply a lack of financial support for the current valuation.

374Water’s First Commercial Unit Just Got A Lot More Delayed… See You Next Year?

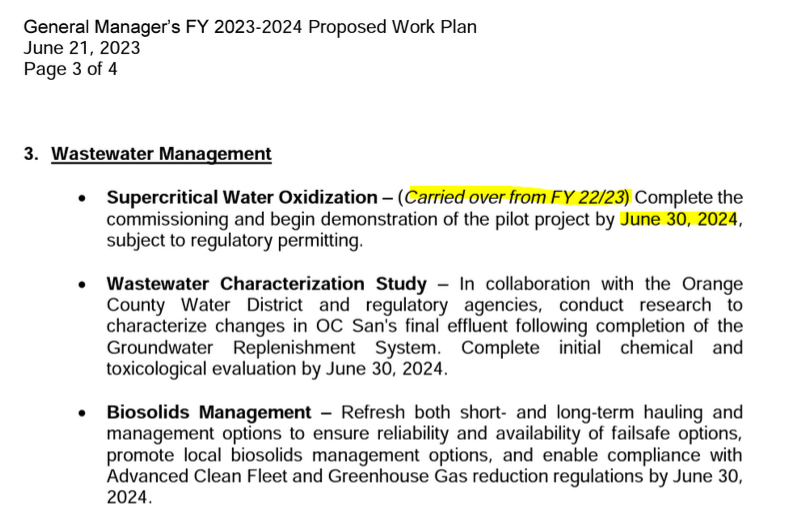

The day of our initial report SCWO’s only customer so far had a meeting. As we noted in our initial report, SCWO management guidance is that the project would be completed by summer 2023. OCSan has now moved their pilot plant commissioning goal back by one year, from June 2023 to June 2024:

We view this as particularly relevant to SCWO’s short term viability as a functional company, given that OCSan’s General Manager of operations told his management in public meetings last year that other potential SCWO customers are waiting to see if this single project in Orange County is even viable before placing a purchase order.

On that note, in the same June meeting, a OCSan commissioner stated, regarding the 374Water research project, that “There’s an understanding that we don’t know how it’s going to end.” This frank assessment was followed by nervous laughter:

It seems OCSan now expects installation to begin in August of 2023, as stated in the linked meeting.

This project is running about 10 months late already, and it seems like people on the board are expressing skepticism about the timeline and the likelihood of success. They are excited about the prospect of potentially moving this forward if it works, though.

When one looks at companies like this (not pre-revenue but close), we would like to see the deliveries happening on time and schedule and a customer excited about the project.

So with the OCSan pilot project once again delayed, SCWO management could be forthright about the challenges, or they could spin a new narrative about potential future growth in another market. You’ll never guess which path they chose!

374Water’s Deal Down Under

On July 5th, instead of announcing the delay of their first commercial unit, SCWO put out a very vague press release. Let’s break it down.

374Water Inc. (Nasdaq:SCWO), a global social impact and cleantech company offering an innovative commercial waste solution for the environment, has formed a strategic partnership with The Environmental Group Limited (EGL) to combat PFAS contamination in Australia and New Zealand.

The agreement is for The Environmental Group Limited (“EGL”) to be the exclusive distributor for SCWO’s units in Australia and New Zealand.

Under the terms of the agreement, EGL will act as an exclusive distributor for 374Water's AirSCWO technology throughout Australia and New Zealand. Additionally, EGL will be responsible for servicing and supporting systems deployed in the region during the term of their partnership. The collaboration is set to kick off with an initial order for an AirSCWO 6 system upon execution of the agreement.

We wonder why the order will kick off upon the execution of the agreement when like two paragraphs ago they were announcing they had formed a strategic partnership, but we digress.

EGL is a publicly listed Australian company, which gives us some insight into their financials and ability to make such a purchase. EGL is listed on the ASX with a market capitalization of $75M AUD ($50M USD). In the 3.5 years between June 2019 and December 2022, EGL spent a combined $843,000 AUD ($562,000 USD) on Property, Plant, and Equipment purchases. While 374Water’s press release implies that EGL is buying an initial SCWO system for themselves, we find it hard to believe that they will be spending five to six times their total three-and-a-half year trailing capex on a single $3.5 million dollar (or more) piece of experimental equipment for their own use and ownership. Not to mention EGL only has $1.7 million in cash on its balance sheet. A potential order, with what money?

We do not doubt that EGL, the consulting firm, would love nothing more than to sell a bunch of these units Down Under to their clients. This press release confirms they are indeed the sole distributor in Australia and New Zealand. The problem for 374Water management isn’t finding distributors, it’s actually selling units to end users. SCWO has found a sole client (in OCSan) in the entire United States to buy a single discounted unit for research purposes. Nothing in this press release implies a burgeoning sales demand.

Another point: this deal was first announced in February by EGL themselves. 374Water management did not think the MOU signed then was worthy of a press release or an 8-k filing with the SEC, but now it does. We question if this announcement last week was about materiality or simply another distraction from their anemic sales push and delayed progress on deploying unit #1 in California.

We think SCWO will continue to find new 52-week lows as their primary customer has delayed installation and sounds positively ambivalent about the likelihood of success. We continue to be short shares of SCWO and will continue to follow the company closely.