374Water (SCWO): A “ShitCo” Set To Circle The Drain

Forever chemicals in our rivers, microplastics in our drinking water, and shit everywhere. Such is the world we inhabit, and it is probably going to be a problem. 374Water (SCWO) claims to have a solution to all those problems, and it fits in a shipping container.

Every year a new set of companies are added to indices like the Russell 2000 and S&P 500. Companies that have performed poorly over the last year or have been acquired are kicked out, to make way for a new wave of new companies. If a company is added to the Russell 2000, then a certain number of shares need to be purchased by a massive number of funds that index to the Russell 2000. And then another crop of investors attempts to “arb” those trades. This creates buying momentum from a host of traders and holders that generally don’t care much about what they own, fundamentally.

So almost every year, small-cap stocks begin to run up massively into the Russell addition. It’s a boon for liquidity. Some companies, the less scrupulous ones, use this addition for exit liquidity. Every year we see this. Two years ago, we showcased issues at Hall of Fame Resort & Entertainment (HOFV), which had run up 50% into the Russell inclusion as investors woke up to the fact they owned a stock that was trying to build the Disneyworld of Football in Canton, Ohio. After the stock ran up into the inclusion and our report came out, selling soon started. Two years later, the business has not managed to grow, and shares are down 95% from our report. Every year we see something like this play out.

This year we have found what we believe is the most overvalued and overhyped stock coming into the Russell 3000, it’s a literal “shitco.” Its business is building a modified shipping container that can take municipal and industrial waste and turn it into clean, drinkable water. Shares have rallied 30% into the Russell 3000 addition and 1,500% since its reverse merger. The company claims to turn industrial sludge and waste into clean drinking water.

The COO was the number two person in a massive Ponzi scheme where he was the President for years. Its business is one prototype and one unit, less than $1m in total revenue, and $8m in cash, with a manufacturing partner that started the company on a coin flip. All of that at a nearly $300m valuation!!!

After spending months talking to experts in the field and evaluating the science of the company, we have shorted shares of 374Water. We think the company is underfunded, is promoting a technology that has been around for a long time and has shown no signs of economic traction in the marketplace. We see nearly 95% downside.

From Reverse Merger to Russell, A Brief History of 374Water

SCWO is an acronym for Supercritical Water Oxidation, a complex chemical reaction that occurs when water, under high pressure and at 374 degrees Celcius, enters a supercritical state. No longer technically just a gas, water, under these supercritical conditions and in the presence of added oxygen, will rapidly degrade (or oxidize) organic compounds (comprised primarily of Carbon, Oxygen and Hydrogen atoms) into simple CO2 and Water.

The SCWO reaction is not a novel process. The oxidizing ability of water in this supercritical state has been known for over 50 years. And indeed, SCWO systems have been deployed on an industrial scale for 20 years. Many of these projects have been mothballed due to poor unit economics and finicky chemistry challenges; the few units that remain in operation manage simple, consistent process streams, usually of highly toxic chemicals dissolved in wastewater.

Long History Of Supercritical Water Oxidation Failing

What 374Water is promising to investors and potential clients isn’t the treatment of specialized waste streams that are extremely expensive to treat in another fashion. They are pitching one size fits all SCWO units, packaged in modified shipping containers, that can handle one of the most common waste streams in the modern world: wastewater sludge and biosolids (aka shit).

374Water went public in April 2021, merging with PowerVerde. PowerVerde was a Coral Gables-based company that was attempting to build and market electrical power systems that would generate zero emissions. That company was led by Danny Bogar, who previously was the second in command at the Stanford Group Ponzi scheme. One of the most costly Ponzi schemes, the Stanford Group was a nearly $8 billion Ponzi scheme.

Currently SCWO’s chief of business development, he supervised the Stanford Group’s compliance practices and was the authority on the sale of their premier product. While the SEC would note he regretted his time there, he still appeared closely affiliated with the scheme and was barred from the securities industry.

This Initial Decision (ID) concludes that Daniel Bogar (Bogar), Bernerd E. Young (Young), and Jason T. Green (Green) violated the antifraud provisions of the federal securities laws while employed at a broker-dealer owned by convicted Ponzi-schemer R. Allen Stanford (Allen Stanford). The ID orders them to cease and desist from further violations and bars them from the securities industry.

Since the reverse merger, 374Water has commercially launched its product, to little fanfare. The only entity to purchase one of the units said they “didn’t elbow anyone out of the way” and the income statement and balance sheet reflect these facts. We just don’t think there is enough commercial demand for a product yet, a fact reflected in 374Water’s income statement.

374 Water Keeps Signing Contracts That Do Not Show Confidence in a Profitable Product

In the world of investigating cash-incinerating, publicly traded startups with a flashy pitch, a proof of concept, and little else, there is no bigger red flag than the act of signing a contract

under duress. Companies desperate for a PR coup love a signed contract. It signals to the market that someone else, perhaps a company with credibility and a long operating history, believes in them and their technology. It’s the best way to make the stock price go up. That you were squeezed on the contract terms is often easy to obfuscate. These backroom giveaways aren’t clear until later. By then, the pump is on, and everyone on the executive team gets rich, provided they sell their own inflated holdings before the market wakes up, leaving outside investors holding the bag.

Looking into 374 Water, we found two concrete examples of the company diluting shares and selling future intellectual rights in exchange for a stock-promoting PR win.

374Water’s Manufacturing Agreement With Merrell Bros.

In April 2021, 374 Water signed a Binding MOU with Merrell Bros. (“MB”) to manufacture the company’s state-of-the-art SCWO systems. Merrell Bros is a privately held nonhazardous waste management company in Indiana. MB is owned by brothers Ted and Terry Merrell; the company runs a network of disposal trucks and biosolids management facilities. The company collects, stores and manages simple agricultural wastes.

Importantly, Merrell Bros does not appear to have experience manufacturing state-of-the-art industrial equipment. We find this development extremely odd given the supposed level of sophistication in 374’s technology and the desire to quickly ramp production in the near future. 374 spun the MOU and resulting business arrangement as a win because of MB’s client list.

As part of the MOU, Merrell Bros CEO Ted Merrell was offered 3.78 million shares of company stock at a price of $0.30/share; at the time of signing, SCWO was trading at a 150% premium to the exercise price. Additionally, MB was granted warrants for an additional 3.78 million shares at the same 30-cent price.

CEO Ted Merrell was also granted a seat on the board of SWCO. In early September, the company told a local paper, The Kokomo Tribune, that by “next Spring” they anticipated completing a “substantial expansion at its Kokomo facilities, including constructing a15,000-square-foot building to house its new cleantech division.”

The company also told Kokomo Tribune that the “sky’s the limit on hiring more workers for the new division.”

Less than a month later, MB would exercise the warrants at a strike price of $0.30. This triggered mandatory 13-d filing. On this day, with the stock trading at $2.10, Merrell Bros had turned their $2.25 million dollar equity purchase into $14.2 million. By January of 2022, that stake was worth $35.6 million.

That $15-30 million in value gained by MB’s owners is several years of operating profits and likely as much as 50% of the value of the company’s business.

Regarding MB’s prediction that the Kokomo facility would have a new 15,000-square-foot building to support SWCO production by the Spring of 2022:

That facility was not built in 2022 and remains unconstructed as of today.

In March of 2022, MB management told the Kokomo Tribune that they were starting production on the first commercial unit to be shipped out to Orange County, CA, in the summer. Today, over one year later, that first unit has not been installed.

Additionally, it appears per LinkedIn that MB has not made a push for hiring engineering or manufacturing personnel since the grand promises of “Sky high” employment possibilities in the Fall of 2021. MB currently has 5 employees on LinkedIn, to further contextualize the size of the share grant they received.

Merrell Brothers Cashes In Before OCSan Gets Off The Ground

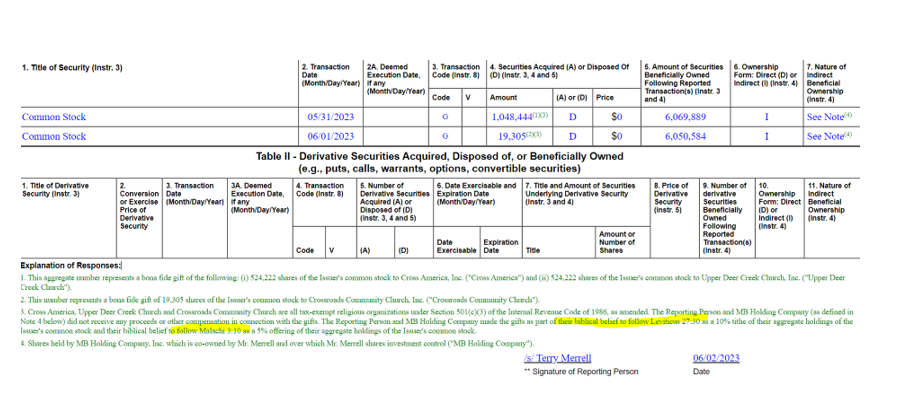

Terry Merrell, the SCWO board member and CEO of Merrell Bros, dumped nearly 15% of his stake in the company in early June. The disposal was reported as a non-profit donation made as “part of their biblical belief to follow Leviticus 27:30 as a 10% tithe of their aggregate holdings of the Issuer's common stock and their biblical belief to follow Malachi 3:10 as a 5% offering of their aggregate holdings of the Issuer's common stock.”

On the date of the donation, SCWO shares were trading at $3.00. Using this price as the basis for the donation, we can call this a $3.2 million dollar gift. While we can only speculate on the tax benefits for Mr. Merrell, we do think it is important to note that his entire stake in SCWO was purchased for $2.25 million.

Oftentimes, corporate board members are a rubber stamp without a great pulse on the actual underlying business. Mr. Merrell, in stark contrast, owns and operates the very company that manufactures 374Water’s only marketed product.

So, that’s their manufacturing partner. How about where these units are supposed to go.

The Orange County Sanitation District Contract was a Phyyric Victory for the Company

In January 2022, 374 Water Announced that Orange Country Sanitation District (OCSan) had agreed to purchase and install a pilot plant for SCWO’s Nix6 system, for processing 6 tons per day of municipal sludge.

"This quarter was marked by progress in building our pipeline of prospective customers that witnessed our first commercial AirSCWO™ 6 system that was purchased by Orange County Sanitation District," said Kobe Nagar, 374Water Chairman and CEO.

So said 374Water CEO in its first quarter press release. But in reality, an OCSan manager said, “they didn’t elbow anyone out of the way” to purchase it.

OCSan is one of the largest public water treatment agencies in the country. Servicing a population of 2.6 million Southern Californians and an annual capital expenditure budget north of $250 million, this agency has to deal with intense regulatory pressure, ongoing water shortages and ballooning costs.

OCSan has up to $10 million of its annual budget allocated for Research and Development, and the agency has a history of being an early adopter and tester of technologies, with varying levels of success.

A multi-million dollar project on fuel cell “tri-generation” with OCSan’s wastewater emissions, for example, resulted in several publications and awards in 2012, but that technology is neither widely adopted by the industry nor OCSan themselves, over a decade later.

The SCWO project was initially scoped by OCSan’s operations committee to the utility Board of Directors in July 2021. After several contract revisions, OCSan’s Board of Directors approved the deal in December 2021.

OCSan, being a not-for-profit public utility, has extensive public records. We went through several months’ worth of presentations, contracts and budgets and came away shocked. SCWO, the company, has convinced investors that this contract is an explicit endorsement of their technology, but we think the Public records show otherwise.

The OCSan Board of Directors balked at the initial contract

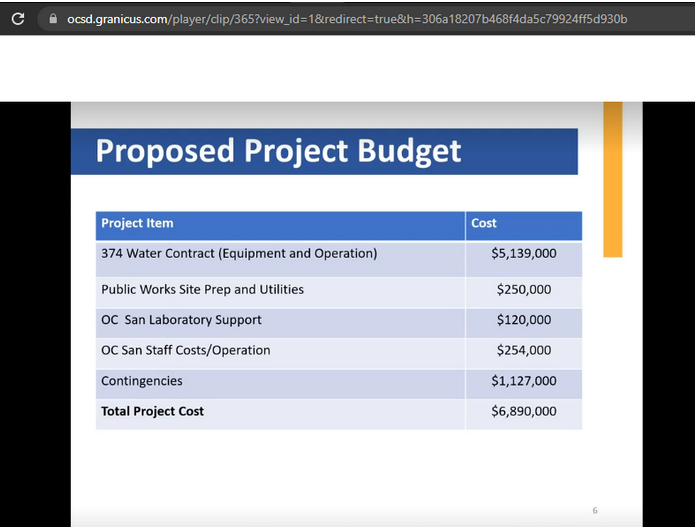

In a November 2021 meeting, OCSan’s operations General Manager presented a research project, worth approximately $6.8 million, to the committee, involving the purchase of one of SCWO’s small plants.

We listened to many of the OCSan meetings and came away thinking that they believe it can be a viable technology but heavily caveat the project as “research” and have expressed skepticism about some aspects of the transaction.

“Do we have any proprietary ownership rights in the intellectual property on a going forward basis? If we do this scale up to six MGD I think a lot of people now are very suddenly interested in this technology. 374 is a company I would imagine with a proprietary technology. They stand to make a very sizable return. Yet we're the ones putting up all the equity to allow them to do this. So I guess my question is, if we were, you know, a venture capital firm, we'd have a big chunk of ownership going forward. “

-OCSan Commissioner, 2021 meeting (public record)

2. 374 Water Gave away Intellectual Property Rights in an Updated Contract

One month later, in December 2021, an updated contract was presented to the Board and we believe SCWO showed their desperation here. The updated contract included an added section for intellectual property rights.

OCSan, without paying a dime more to the company, extracted permanent licensing and IP rights for any new methodologies, techniques, or discoveries made during the trial run of the plant. We believe that 374Water signed away potentially millions of dollars of intellectual property rights in the event that this Pilot project is successful. Any future-looking earning projections with SCWO should consider that the company gave away much of the value it would extract from completing a successful pilot at OCSan.

3. 374Water Will Lose Money On The OCSan Pilot Project

OCSan’s Operations manager, in the December meeting, presented the following regarding the unit economics of the pilot plant to be manufactured:

“They're (374 Water) selling it us that box at basically their production costs of $2.2 million. Because this box… because one's never been built to scale. They actually anticipate that that will cost them at least three and a half million dollars and they're on the hook for whatever it takes to make it a viable working unit. So they they really bear the risk for any cost overruns or anything where they have trouble making it work. We pay the 2.2 million that's our costs.”

OCSan was told by 374 Water’s management that they are selling the pilot plant for 2.2 million, something that will cost them 3.5 million to manufacture. Given that all parties involved (the Utility and SCWO) seem to treat this as an R&D unit, a negative gross margin product is hardly surprising. But we think that investors are still getting ahead of themselves. This technology is research, and its ability to perform as described is a complete unknown at this point.

4. The OCSan Project Is 10+ Months Past Initial Projections

The initial Contract signed between OCSan and SCWO indicated that the plant would be installed and commissioned in September or October of 2022:

The initial unit still has yet to be installed at OCSan’s plant and commissioning is set to begin “sometime this Summer (2023).” Based on public meeting notes from OCSan, the Water Treatment Plant has had the required infrastructure in place to install 374Water’s SCWO unit since late 2022, leaving us to presume that the delay is entirely a result of 374Water’s slow manufacturing pace. We think that this sort of overly optimistic planning from the company is not a great sign for trusting management.

We would also point you back to the company’s reliance on MB, a company with no previous experience in building sophisticated industrial equipment, as the manufacturer of the delayed unit.

5. OCSan’s Management Admitted There Was Not A Lot Of Commercial Interest in 374Water

One of the most revealing quotes we found in the OCSan records was whether other utilities or water treatment plants were interested in buying one of 374Water’s SCWO units. When asked about this, OCSan’s General Manager stated:

“374 talked to other people (Utility companies) and it sounds to me… and I gotta be super careful. It sounds to me like other people are willing to help if it's free. Meaning they got a grant or they don't have to do anything. Like you're saying it's people are willing to host and write papers…”

-OCSan Director of Operations, 2021 meeting (public record)

When pressed further, the Manager stated that they (OCSan) “didn't elbow anybody out of the way to my knowledge.”

This means that OCSan was the only potential client. This may explain why 374Water was so willing to give away intellectual rights.

And, regarding those intellectual rights….

Duke University Will Be the Primary Beneficiary of any Success Achieved by 374 Water

Duke University has operated a small one-ton-per-day SCWO sludge pilot plant on its Engineering quad for several years, under the direction of Dr. Deshusses. This plant appears effective at removing PFAS and other organic chemicals from the mostly homogenous domestic waste stream of dorm toilets, sinks, and drains. In 2017, the University applied for a US Patent for this specific process to treat sludge, which was assigned Patent number US11420891B2 and granted by the US Patent Office in 2022.

374 Water was a direct consequence of this pilot plant, as the professor and his process engineer were seeking to cash in on this small proof of concept in a big way. There’s one key issue that we think doesn’t get enough attention: 374 Water’s intellectual property is basically non-existent. The company licenses this technology from the University. They are instead selling their process expertise and manufacturing know-how via this company.

We believe this is a key issue and is not properly disclosed by 374Water’s management. Large Universities like Duke hold massive IP portfolios and they do not just give away the rights. 374Water can speak about patented processes, but the royalty payment system is unknown at this time.

Experts in SCWO Chemistry Say Plug and Play Sludge Treatment is a Highly Dubious Use Case

The bulk of our research on SCWO centred on the contractual issues that we believe demonstrate that this company is selling an unproven R&D program as a commercially viable product. With that said, we did speak with experts on the technology around the Supercritical Water Oxidation process itself.

Several experts we consulted with were shocked that someone was attempting to commercialize SCWO technology for normal sewage. This is because the only existing plants that have shown some progress in commercialization to date are for very specific waste streams. For example, process wastewater from speciality chemical plants often contains trace amounts of organic wastes that are particularly hazardous. Because of the extremely high cost of disposal, SCWO can be deployed to remove these hazards.

Specialty industrial wastewater is usually range-bound in concentration and creates predictable and controllable waste for a speciality SCWO reactor to manage. Sludge from municipal wastewater is an entirely different beast. The total organic content of sludge varies wildly from batch to batch. The characteristics of the solids, too, vary wildly from day to day. Because the SCWO process is exothermic and occurs at very high temperatures, these variations are prime candidates for rapidly fouling the insides of the SCWO units, from pumps to pipes to heat exchangers.

374Water’s Precarious Financial Position, Lack Of Commercial Appeal Lead Us To Short Shares

Realistically 374Water is a startup that should not be public yet. It needs to bridge the gap between one pilot project at Duke and a yet-to-be-installed unit at OCSan and more widespread commercial appeal, and we don’t think the company is in the position to do so. Still valued at nearly $300m, we think this former reverse merger will circle the drain as shareholders get diluted by the active at-the-market-offering the company has been using to raise funds. From SCWO’s Q1’23 10-Q:

In December 2022, the Company entered into an equity distribution agreement with an underwriter pursuant to which the Company may offer and sell shares of its common stock from time to time through the underwriter as its sales agent. Sales of common stock, if any, will be made at market prices by any method permitted by law deemed to be an “at-the-market” offering as defined in Rule 415 promulgated under the Securities Act of 1933, as amended. The Company has no obligation to sell any shares of common stock under the equity distribution agreement, and may at any time suspend offers under the equity distribution agreement, in whole or in part, or terminate the equity distribution agreement.

During the three months ended March 31, 2023, a total of 2,137,876 shares of common stock have been sold pursuant to the equity distribution agreement resulting in a total of $8.35 million in proceeds, net of $0.11 million of commission fees and $0.05 million of accounting and legal fees. As of March 31, 2023, $91.5 million remained available under the Company’s at-the-market public facility, subject to various limitations.

Given the cost to manufacture one of these units is in the $3-5m range, and that their only customer so far has said they “didn’t elbow anyone out of the way” to get one of these units, we think the bridge between a small pilot plant and commercial success is too much for 374Water to overcome. And that’s assuming MB can deliver the unit to OCSan, something that should have already happened. Ultimately we think shares will circle the drain as the company will likely need to continue tapping its at-the-market offering if it wants to build more of these units, which seem to have limited commercial interest, at least so far.

Bleecker Street Research LLC Terms and Conditions

By downloading from or viewing material on this website you agree to the following Terms of Service. Use of Bleecker Street Research LLC’s research is at your own risk. In no event should Bleecker Street Research LLC or any Bleecker Street Research LLC Related Person (as defined hereunder) be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities of an issuer covered herein (a “Covered Issuer”).

As of the publication date of Bleecker Street Research LLC’S report, Bleecker Street Research LLC Related Persons (along with or through its members, partners, affiliates, employees, and/or Bleecker Street Research LLCs), clients, and investors, and/or their clients and investors have a short position in the securities of a Covered Issuer (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Bleecker Street Research LLC and Bleecker Street Research LLC Related Persons are likely to continue to transact in Covered Issuers’ securities for an indefinite period after an initial report on a Covered Issuer, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in the Bleecker Street Research LLC’S research. One or more Bleecker Street Research LLC Related Persons have provided Bleecker Street Research LLC with publicly available information that Bleecker Street Research LLC has included in this report, following Bleecker Street Research LLC’S independent due diligence.

Research is not investment advice nor a recommendation or solicitation to buy securities. To the best of Bleecker Street Research LLC’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities of a Covered Issuer or who may otherwise owe any fiduciary duty or duty of confidentiality to the Covered Issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Bleecker Street Research LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition, and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets, and liabilities. Such statements, estimates, projections, and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Bleecker Street Research LLC’s control. All expressions of opinion are subject to change without notice, and Bleecker Street Research LLC does not undertake to update or supplement this report or any of the information contained herein. You agree that the information on this website is copyrighted, and you, therefore, agree not to distribute this information (whether the downloaded file, copies/images/reproductions, or the link to these files) in any manner other than by providing the following link: Bleecker Street Research LLC bleeckerstreetresearch.com The failure of Bleecker Street Research LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to the use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Bleecker Street Research LLC Related Person is defined as: Bleecker Street Research LLC and its affiliates and related parties, including, but not limited to, any principals, officers, directors, employees, members, clients, investors, Bleecker Street Research LLCs, and agents.