Perdoceo Education Corp (PRDO): Going Ghost

Initial Disclosure: Funds managed by Bleecker Street are short Perdoceo Education Corporation (PRDO), American Public Education, Inc. (APEI), Grand Canyon Education Inc. (LOPE), and Strategic Education Inc. (STRA). Please see the full disclosure at the end of this report.

“And so a lot of times, what we see, especially in online learning environments, you can have, sometimes, 90% of a class and they’re not real students. And so, they’re turning in assignments, they’re responding to questions. But these are not real people… there are other people orchestrating this behind the scenes to make money.”

- Jason Williams, Assistant Inspector General for Investigations at the U.S. Department of Education

Key Points:

Perdoceo Education Corporation (PRDO) is a ~$2B market cap, for-profit education company that has seen unprecedented enrollment and retention growth across its online academic institutions, which has driven its stock price up ~200% over the last two years.

In Q1 24, the pace of enrollments suddenly began to accelerate, with enrollment growth at Colorado Technical University (CTU), PRDO’s largest school, peaking at 28% year-over-year. This growth far surpassed the normalized levels management were forecasting just one quarter prior, and well outstripped the ~3% average pre-COVID enrollment growth at CTU.

On earnings calls throughout 2024 and 2025, PRDO leadership highlighted innovative internal strategies, student engagement, and the adoption of generative AI for recruiting as core growth drivers, despite the absence of any obvious, industry-wide shift in genuine student demand for higher education, let alone interest in for-profit colleges over traditional institutions.

Contrary to management’s explanations, the rise in PRDO enrollments and retention rates coincided with a surge in enrollment fraud orchestrated by criminal networks—an issue that national media reports have characterized as widespread across the education sector.

So-called “ghost students” at the center of this fraud get churned out by a combination of sophisticated criminal networks and individual actors, who use extensive lists of stolen identities and SSNs to present themselves as online students. These fake students enroll in full courseloads at target institutions; fill out FAFSA applications to apply for financial aid (Pell Grants and federal loans); stick around as long as possible to avoid being disenrolled and losing aid disbursements, typically by submitting AI-generated coursework; and repeat the process with a new identity once they have harvested as much aid cash as possible.

Our investigation revealed that PRDO’s main campuses, Colorado Technical University (CTU) and American InterContinental University System (AIUS), lacked upfront verification controls in their admissions process, permitting applicants with entirely fictional names to enroll. We were able to enroll using the name of a cartoon character.

Third-party estimates suggest ghost students comprised roughly ~31% of community college applicants in California for the 2023-2024 academic year and up to 20% across the nation. We believe ghost students are also proliferating at for-profit colleges.

The scale of the scheme is massive. U.S. Department of Education Secretary Linda McMahon recently estimated that the US was losing $1B per year in fraudulent student aid to ghost student scammers.

Per a former University of Phoenix executive we interviewed, this is a known issue in the for-profit industry: “When you’re publicly traded and you’re competing against other schools and you’ve been sharing an enrollment number that’s been growing at a certain clip, if that wasn’t taking into consideration fraud, that changes the number for the entire time you’ve been reporting it. At what point are you able to go to analysts and everyone else and say, ‘Hey, this isn’t new. There’s always been fraud, we just didn’t know how to capture it.”

We estimate that ghost student fraud constitutes ~8% of PRDO revenue and ~34% of operating income, assuming the midpoint of potential ghost student enrollment (5-15%) estimated by industry experts.

To combat ballooning financial aid fraud, the Department of Education has launched a federal crackdown over the past few months, phasing in enhanced identity verification for FAFSA applicants and requiring schools to adopt stricter compliance. The Department of Education plans to mandate further biometric and real-time identity checks in the 2026-2027 academic year.

We believe that for-profit colleges such as PRDO, with their open admissions and profit-driven student intake policies, are the perfect breeding ground for ghost student scams and are already suffering from recently implemented anti-fraud measures. In our view, institutions like PRDO have operated with minimal oversight in the absence of regulatory action: our investigation revealed it would have been possible for a ghost student to pass through an automated admissions process with little human oversight beyond phone screenings. With a crackdown already in effect, we believe PRDO’s enrollments will nosedive, and net income will erode accordingly.

Introduction

Perdoceo Education Corporation (PRDO) is a for-profit education company that primarily offers online degree programs through its three accredited institutions: Colorado Technical University (CTU), The American InterContinental University System (AIUS), and the recently acquired University of St. Augustine (USAHS). Over the last several years, the company has reported unprecedented enrollment growth and elevated student retention. Investors have rewarded these results, sending PRDO shares up approximately 200% over the past two years.

Management has consistently attributed this growth to increased interest from prospective students and operational improvements across its academic institutions. On earnings calls, PRDO leadership has highlighted technological initiatives, marketing efficiency, and of course a sprinkling of generative AI magic to explain its historically anomalous rise in enrollments. Since growth inflected in Q1 24, management has repeatedly painted the surge in enrollment and retention as both sustainable and indicative of long-term operational excellence.

We do not believe this narrative reflects reality. Our investigation suggests that the enrollment and retention figures at PRDO are materially inflated due to an influx of fraudulent activity in the for-profit education sector. This issue has impacted nearly all of higher education. The scale of this fraud is massive, and it is now coming to an end.

Perdoceo has been public for nearly 30 years, and CTU, its largest school by enrollments and revenue, has existed for 60 years, exhibiting modest, steady enrollment trends. From 2013 to 2019, student enrollment grew at ~3% annually. COVID-19 provided a temporary stimulus, driving enrollments up to 14% year-over-year before normalizing by 2023. During COVID, PRDO management credited operational and technological improvements for these spikes. Once the COVID wave reversed and performance declined, PRDO pivoted to blaming macro headwinds and regulatory factors. In Q4 23, just one quarter before enrollment growth inflected, PRDO management said “marketing and student enrollment activities have mostly reverted to normalized levels”, implying ~3% growth was a reasonable long-term average.

What PRDO Says About This Sudden Boom

During the recent enrollment surge, PRDO management was quick to toot their own horn, just as they did during COVID. PRDO cited generative AI recruiting efforts, robust student engagement, and strategic acumen as reasons for the sudden enrollment increase: gone was the muted environment PRDO management described just one quarter prior.

In Q1’24, management highlighted a 28.5% increase in total CTU enrollments, citing a “higher number of enrollment days for the current quarter” and asserting that marketing and enrollment activities drove the growth. They projected that CTU enrollments would continue to rise through the year, “primarily driven by high levels of student retention and engagement”.

This narrative persisted through 2024. In Q4’24, executives emphasized that enrollments demonstrated the strength of PRDO’s operating model: “The enrollment trends we are experiencing have reinforced and validated our strategy of optimizing and prioritizing student experiences and academic outcomes that we believe should ultimately support sustainable and responsible growth… We are entering 2025 with student retention and engagement near multiyear highs and expect to operate at or near these levels through the next few quarters.” Management also underscored that improvements in retention and engagement would counteract regulatory impacts, stating: “Strong levels of prospective student interest for CTU and AIU system as well as sustained improvement in student retention and engagement should offset the headwinds from the U.S. Department of Education student loan initiatives program that have ended or are expected to change or end in 2025.”

In Q2’25, management doubled down, claiming that “momentum in student retention and engagement… has been trending near multiyear highs”, with “increased interest from prospective students looking to pursue a degree at our academic institutions.” They further highlighted seven consecutive quarters of enrollment growth at CTU and the highest AIUS enrollments in over a year, attributing these outcomes to refined marketing strategies and the use of generative AI to identify prospective students “who we believe are more likely to succeed at one of our academic institutions.” Total enrollment growth in Q2’25 was 17% year-over-year, including gains from the St. Augustine acquisition.

Such results and commentary have sent shares of Perdoceo surging higher.

PRDO’s Enrollment Growth Booms As Crime Rings Proliferate

We do not think Perdoceo management understands what has been driving outperformance in enrollments and retention. This growth coincides directly with the acceleration of fraudulent college applications and enrollments, which inflected in the same Q1 2024 to 2025 period. Enrollment fraud at California community colleges skyrocketed during 2024, as Associated Press reporting showed:

Meanwhile, ballooning PRDO enrollments in 2024 and YTD 2025 drove hefty margin improvements:

Investors should take a step back and ask themselves what has fundamentally changed about student behavior that augments retention and enrollment characteristics. Incremental improvements like easier-to-fill FAFSA forms do not themselves drive students to enroll into a 4-year degree program; go through coursework, even if AI-assisted; and potentially incur student debt. The number of individuals interested in going back to school has not dramatically shifted, and these institutions have not found some untapped well of bodies or rekindled interest in academia or professional programs. A former CTU faculty member told us 5-15% of students were ghost students:

“I can’t divulge specific internal numbers, but what I can say is if looking at California being ~25% as a reference - then I would, looking at our admissions policy, ballpark it’s probably going to somewhere between 5-15% of students are frauds, because for many of the enrollment processes they do require some human interaction, but with AI you can answer simple phone call questions.”

– Colorado Technical University - Former Lead Faculty and Associate Professor

A former executive at competitor University of Phoenix also estimated a 5-15% ghost student penetration in the industry:

“I would think at most of these schools between 5-15% of students, there is a concern of fraud within those students.”

– University of Phoenix - Former Dean & VP

When surveyed about ghost student behaviors and patterns, for-profit faculty shared the complexities of managing the problem:

“The pattern with students is that the first assignment they are to introduce themselves and a clear pattern is that they submit a strange submission. Specifically, they submit something where it matches other students from other sections nearly word for word with only a name and location changed in the text. Additionally, another pattern is a lack of communication. I send students messages at least twice a week and I can tell if they have read it. Ghost students never read them or have very canned responses.”

– Colorado Technical University - Adjunct Professor A

“It's very difficult to identify - because if you do not hear from them there’s not much faculty can do, I know the University through Student Services reaches out as well… this semester I have students that have repeated and it has been very tough as students are not responding or the response rate is very far and few between.”

– Colorado Technical University - Adjunct Professor B

“Faculty at some of these institutions get paid based on whatever registration was and that’s a ginormous amount of money, and when you go from telling a faculty member you’re actually not getting paid $8,000 you’re getting paid $2,150 - so faculty just then think I’m not dropping anyone. So part of the problem is that it makes everyone think criminally.”

– University of Phoenix - Adjunct Professor A

In our investigation, we discovered a lack of verification controls across Perdoceo’s schools, and per insiders in the industry broadly, we believe that $8-26M of revenue and ~17-51% of operating profit is driven by enrollment fraud that is now closed.

The Ghost Student Phenomenon: How Crime Rings Have Extracted Billions In Fake Federal Financial Aid In A Wealth Transfer Facilitated By For-Profit Education

The ghost student schemes first sprung up at US community colleges. National reporting (PBS News, AP News, Fortune, Hechinger, Washington Times) has tracked how sophisticated criminal networks and fraud rings began using stolen identities to enroll in community colleges under the guise of applicant students in 2021. Since then, ghost student fraud has evolved into an escalating cat-and-mouse game of scammers trying to extract financial aid (Title IV funding) while local colleges attempt to identify and remove the fake students from classes. Fraudsters targeted community colleges because of their open enrollment requirements and the online nature of the courses, which are very similar to analogous programs at for-profit universities. The scammers had the intention of maintaining enrollment and receiving as many aid disbursements as possible net of tuition and fees in the form of Pell Grants and federal student loans over the course of each semester. Generative AI has further aided the scheme by allowing ghost students to submit homework assignments and maintain the appearance of genuine activity in asynchronous online class settings, making detection difficult for professors and administrators while siphoning taxpayer dollars and university resources as well as classroom seats reserved for genuine students interested in an education. The scale of the issue has continued to balloon: the latest estimates by the California Chancellor’s Office for the 2024 academic year believe ~31% of applicants in California in the community college system across 1.2M applicants were from ghost students, with the rest of the U.S. experiencing similar levels ~with 20% of applications coming from ghost students per third-party estimates.

The prevalence of the issue has also been observed by the Office of Inspector General (OIG) in recently published materials as of July 2025 including their FraudGram Newsletter, now on its fourth issue since launching in early 2024, and Fraud Watch alerts which highlight recently announced cases and pending investigations. Per their latest reporting on analyzing just a small subset of FAFSA data, the OIG found heightened potentially fraudulent activity, specifically tied Parent PLUS loans, with “a notable increase in activity during award year 2024–2025”.

In a separate interview in July 2025, the Assistant Inspector General succinctly described the breadth of the issue:

“And so a lot of times, what we see, especially in online learning environments, you can have, sometimes, 90% of a class and they’re not real students. And so, they’re turning in assignments, they’re responding to questions. But these are not real people… there are other people orchestrating this behind the scenes to make money.”

- Jason Williams, Assistant Inspector General for Investigations at the U.S. Department of Education

Based on our investigation, we believe that the ghost student phenomenon that has been haunting community colleges across the nation for the past few years has also been plaguing the for-profit education industry and acting as a key driver of both growth and profits at companies including PRDO.

The ghost student threat came to a head in Q2 25, when the Department of Education (ED) stepped in to launch a federal fraud prevention program. The program consists of escalating phases that aim to eradicate ghost students:

The introductory Phase I activated in the summer term of 2025. It imposes stricter verification on solely first-time FAFSA applications, with a greater number of applicants being flagged and required to provide identity verification.

The much more comprehensive Phase II just began in the fall term of 2025, and introduces permanent additional screening processing for all FAFSA applicants going forward. In addition, Phase II requires schools to verify students in advance in a NIST IAL2-compliant manner, which requires valid government-issued IDs.

The Department has announced it is beta testing plans for an additional layer of real-time identity verification for the 2026 - 2027 school year. This new system will be tied to SSN and tax filings, which will make ghost student fraud even more difficult, as it shifts the identification burden to Federal Student Aid databases and away from individual educational institutions.

There is a distinction between for-profit universities and community colleges that we believe makes for-profits uniquely susceptible to ghost students. While community colleges are incentivized to weed out fake students, as they take the place of real enrollees and are harmful to professors' curricula, online for-profit colleges are focused on maximizing enrollment growth and tuition fee revenue. These incentives we view as fraud-friendly get compounded by for profit schools’ open admissions, in other words, 100% acceptance rates. To make the incentive to turn a blind eye even stronger, ghost students flow through at high incremental margins in for-profit universities, as they are not likely to drop out of their own volition; they use minimal university resources; and they inflate KPIs such as new enrollments and retention, since they intend to stay in the system as long as possible while submitting AI-generated assignments.

Since late 2023 and early 2024, leading for-profit education companies have reported elevated enrollment in the majority of periods without a secular tailwind of a return to academia or a shift in demographics:

The pie hasn’t grown and there aren’t market share capture dynamics involved, which suggests some other reason for for-profit schools’ simultaneous outperformance. After conducting primary research and industry interviews, we believe this reason is enrollment fraud.

Spongebob Goes Back to School

To determine the ease of ghost fraud at PRDO, we validated existing admissions and applications controls at PRDO’s largest institution, CTU. CTU comprises ~69% of total PRDO enrollment as of Q2 25, and, like fellow PRDO institution AIUS, virtually all of CTU’s enrollees are online students. We applied with varying levels of completely fictional profiles and details, including name, address, SSN, and educational history. Our profiles ranged from plausible personas to known children’s cartoon characters to completely random numbers and letters on applications. To our surprise, the admissions portal had no controls whatsoever: for example, even Spongebob Squarepants was allowed to complete an application despite having a fictional name, address, and social security number. Spongebob applied to pursue a bachelor’s degree in criminal justice and was immediately pointed to fill out a FAFSA application:

We decided to continue the admission process with one of our fictional characters, and we were fully admitted to CTU and ready to begin signing up for courses in the current academic year:

After enrollment, the primary area of concern for PRDO seemed to be financial aid documents and FAFSA application completion, in order to maximize Title IV funding from “student” enrollment:

Despite not having submitted any verification, not fully participating in class, or submitting assignments, we were not dropped from the course a month later, and continued receiving successive course units. CTU gave us the option to revise prior assignments regardless of missed deadlines, presumably to maximize enrollment and class retention figures.

We also wanted to verify whether this was an isolated issue at PRDO, so we attempted to enroll at PXED with similar varying levels of fictional information, and once again, we were granted enrollment immediately with no checks on information submitted, and we were urged to complete a federal financial aid application with one of the submitted profiles.

With no identity verification or education verification upfront, we were also able to enroll in courses. In PXED’s case, we were eventually dropped due to lack of attendance, but that is something a ghost student would have little problem keeping up with using generative AI.

For ethical and legal reasons, we did not apply for federal funding or financial aid at either institution. However, it is clear that a fraudster would be able to use the lax verification to deploy stolen real identities; maintain the appearance of continued enrollment; to complete homework tasks using AI; and request—and likely receive—federal aid as a student at these institutions due to a lack of controls. It seems the for-profit education industry had effectively outsourced verification to the federal government via the FAFSA application, which itself was rife with fraud until recently. Meanwhile, the ED had simultaneously been relying on these schools to play a part in student verification. This shortfall left neither party completing the task until last month.

The Crackdown Commencement

In October, we saw the Department of Education’s enhanced verification measures go live in real time. As part of Phase II of its program, the ED stepped in to require upfront verification from educational institutions, with multiple for-profit peers now mandating that applicants submit proper government identification in the so-called V4 and V5 verification groups as part of their application process. The ED also tightened the FAFSA identity verification process:

When we again submitted applications in October with varying levels of realistic and unrealistic student information, for-profit education portals now required us to submit both government identification and ID proof in order to meet verification standards outlined by the ED. The new verification process is handled by third parties like PingID, Jumio, and Intellicheck:

We believe this change has caused the opportunity for ghost student fraud to diminish massively. The additional burden of a substantive verification requirement heavily impacts new student growth, both fraudulent and real, and we’re starting to see the cracks form in the for-profit education space in industry earnings and commentary. Key players have begun to indicate softer enrollment growth going forward, although they tend to downplay the role of fraud, instead pointing to marketing changes, cyclicality, or operational and vendor issues.

LOPE reported a Q3 25 revenue miss and attributed it to the government shutdown, while signaling that online enrollments and retention will continue to decline:

Strategic Education (STRA) reported “softness” in new enrollments and said the company would increase marketing expenditure as a result:

STRA, LOPE, and Adtalem Global Education (ATGE) also flagged similar enrollment issues and “softness” at their post-licensure nursing programs, which are taught online, due to either marketing issues or competition:

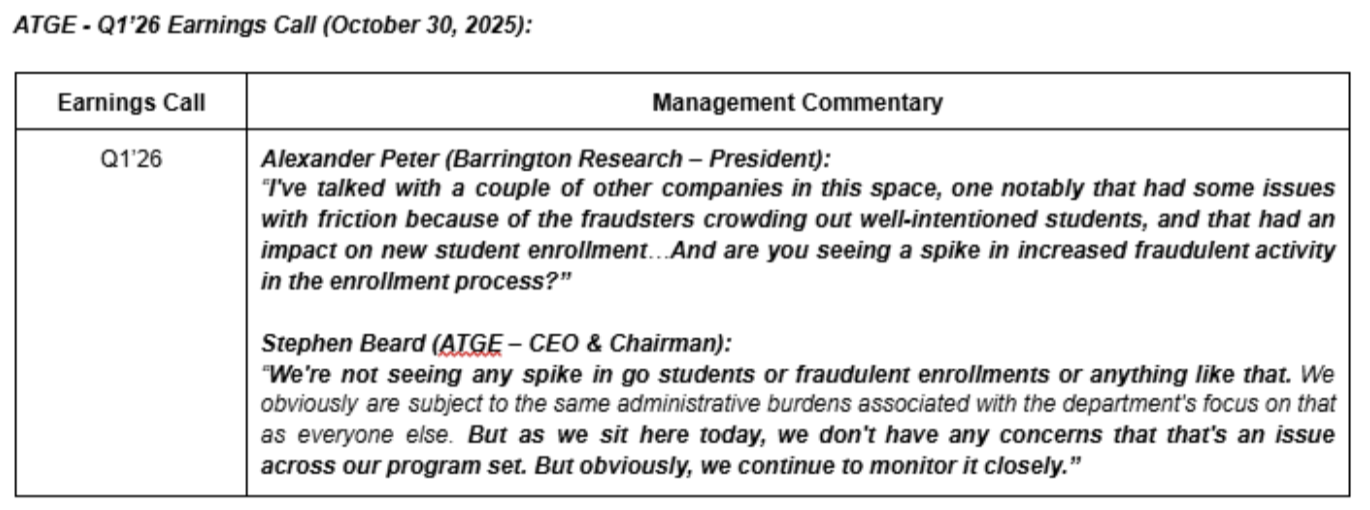

For ATGE in particular, this stumble came on the heels of comments just one earnings call prior, in which management was touting its 10th consecutive quarter of enrollment growth in both pre-and-post licensure at Chamberlain and its solid position heading into fiscal 2026.

We believe the primary driver of these post-licensure enrollment problems was the DOJ’s Phase II of Operation Nightingale, cracking down on fraudulent diplomas by for-profit nursing schools in their RN and pre-licensure degree programs. The DOJ announced Phase II fraud charges on September 15, 2025. During Phase I of Operation Nightingale in 2023, ATGE nursing students were reported to have potentially fraudulent pre-licensure credentials while enrolled in its nursing school, so it is clear that fraud is prevalent in the industry. We believe that across for-profit education, management teams are now having to take enrollment and verification seriously before the federal government comes knocking.

In October, an analyst asked ATGE management whether the September intake issues were tied to fraud. ATGE’s CEO suggested fraud wasn’t an issue across their programs, despite the rapid reset in growth outlook.

We believe fraud issues extend outside higher education to primary and secondary education, too. In its most recent earnings call, Stride Inc. (LRN) also blamed marketing issues for its growth deceleration and told investors to temper enrollment expectations going forward:

Yet, just a month prior to LRN’s earnings, on September 14, 2025, the Gallup-McKinley County Schools Board of Education filed a lawsuit against LRN alleging fraud, saying LRN lacked necessary controls and retained ghost students to inflate enrollment numbers while ignoring verification and compliance requirements to secure state funding for students.

This is not the first time LRN has been allegedly caught with its hand in the public’s cookie jar. Back in 2016, LRN settled with the California DOJ over the same issue of inflating enrollment figures to extract taxpayer and state funding, back when it was named K12 Inc.

With management teams across the sector tempering expectations, Street earnings estimates have fallen across the board for Q4 2025.

However, we believe that these earnings call forecast walk-backs are just the tip of the iceberg, and that the ongoing ghost student clampdown will have a sizable and lasting impact on the industry. Phoenix Education Partners (PXED), which has just gone public after a long stint under private equity ownership, went as far as telling analysts to expect no growth for 2026:

These industry warnings underplay the longer-term impact of the fraud reduction roadmap that the federal government has already put in motion. The recently implemented verification measures primarily affect new student enrollment growth, but the ED and DOJ are also focused on rooting out fraud among the existing student population, which we believe will only further dent enrollments and net income at PRDO and in the industry at large. For example, the ED intends to enforce additional verification measures on all future FAFSA applications starting in the ‘26-’27 FAFSA year. Fraudsters already enrolled in degree programs who fail identity checks will also be rooted out in short order and denied disbursements in the coming 2026 FAFSA renewal period, which we believe will cause a significant decline in industry retention rates and earnings.

PRDO Management Is Voting With Their Pocketbooks: Selling Stock While School Heads Are Dumping

While PRDO management has seemed unaware, either willfully or intentionally, of what has been driving PRDO’s outsized historical results, their stock sales imply that they are not waiting around to take money off the table. Over the last twelve months alone, the PRDO management team and directors have sold ~$44.1M worth of stock.

Collectively, PRDO executives and directors have sold ~48% of their common stock and vested RSU holdings. CEO Todd Nelson has sold 40% of his total unvested position, while the senior management leading each of PRDO’s schools have all sold nearly their entire common stock positions:

We believe these sales are well timed, as we estimate below that the financial impact of 5-15% of PRDO’s students being “ghost students” means a significant decline in revenue and profitability.

We estimate PRDO Faces a ~20% YoY Earnings Decline in 2026 Alone

With a potential 5-15% of potential ghost student enrollments, we estimate that PRDO has inflated operating income by ~34% at the midpoint, with operating margins declining to ~17% versus the reported ~24%. Furthermore, when adjusted for a 10% ghost student rate, CTU’s Enrollment CAGR from 2023 to Q3’25 falls directly in line with the historical enrollment growth average of ~4%.

Translating the estimated ghost student impact into its effect on future earnings, we believe PRDO’s enrollment growth will decline precipitously starting in Q4’25 as enrollments flip negative, with a ~7% compression in 2026 total enrollments, while operating margins revert to the long-term mean. Due to Title IV regulations, institutions can’t receive commissions, bonuses, or incentives tied to enrollment or recruiting, so for-profit businesses’ cost structures have historically been largely fixed, with few embedded variable costs. Historical total OpEx was a consistent ~$550M from 2020 to 2024. This fixed cost base allowed the business to experience significant operating leverage and margin expansion from 2024 onwards, though management also acquired the USAHS school in December 2024, which added five physical campuses and increased headcount by ~30%. Operating leverage works both ways, and we expect significant post-verification earnings pressure starting in Q4’25 as growth falls alongside admissions while advertising spend rises to a normalized level. We estimate a ~20% decline in EPS from 2025 to 2026.

The Fundamental Headwinds Facing The Sector Go Beyond The Ghost Student Issue

The for-profit education industry, and PRDO in particular, faces problems outside of enrollment fraud. As the moratorium on student loan repayments ended, the ED sent institutions a notice letter in May 2025 to engage colleges in reminding alumni of their student loan requirements. Over 1,000 colleges were at risk of losing access to federal aid due to loan nonpayment:

The ED published interim data on non-repayment rates, a reasonable proxy for default rates, and reminded schools that, “institutions will lose eligibility for federal student assistance, including Pell Grants and federal student loans, if their Cohort Default Rate (CDR) exceeds 40% for a single year or 30% for three consecutive years”.

While the next full CDR data release showing post-moratorium default rates, does not get published until September 2026, the current interim data shows both of PRDO’s primary institutions are above the 40% threshold and are at risk of losing Title IV funding if those rates are not lowered by the next release date. At the very minimum, even if PRDO does manage to encourage borrowers to begin repayment, it is unlikely PRDO will fall below the 30% threshold, meaning that year will count as one of their three consecutive annual “strikes”.

PRDO’s third and latest addition, USAHS, is also facing additional scrutiny. Per the latest June 2025 federal data sets, it is under program review for Heightened Cash Monitoring (HCM) by the ED. USAHS’s HCM1 classification is due to deficiencies regarding its financial responsibility score, which measures the university’s ability to meet operational and federal student aid obligations.

The industry writ large is also experiencing multiple competitive and regulatory headwinds heading into 2026 that are putting pressure on tuitions. Traditional universities are facing enrollment cliffs among both domestic students, due to demographics coupled with worsening college degree sentiment, and international students, due to updated visa policies and paused interviews in 2025. As a result, many colleges are launching online programs to fill the gap and find new avenues for growth, particularly in the most common and profitable graduate programs: business, nursing, and healthcare administration.

This supply growth has been further exacerbated by the OBBB Act setting new federal loan caps, phasing out certain graduate loan programs, and applying further regulatory scrutiny to Title IV funds. Among these new provisions are the “Do No Harm” assessment requiring undergraduate programs to have earnings power greater than high school graduates’ and graduate programs to have earnings power greater than bachelor’s degree earners’, which come in addition to prior gainful employment policies:

As a direct result of these new policies and increased competition, several traditional schools have begun announcing tuition cuts or discounts to encourage graduate enrollment, with some slashing headline tuition up to ~40% for cost per credit hour rates:

Discounts and cuts have brought the cost of various Master’s programs offered by traditional universities closer in line with the tuition costs of CTU and AIU, which are $610 and $652 cost per credit hour, respectively, diminishing PRDO’s value proposition–and that of other for-profit universities–accordingly.

Graduate programs are very profitable: though they are shorter in duration, they charge almost double the tuition per credit hour. As a whole, university systems tend to operate on cross-subsidization, in which higher-margin fields and courses cover the budgets of other departments: lower-cost online courses subsidize in-person classes, humanities programs offset the higher costs of STEM instruction, and graduate students subsidize undergraduates.

Per our estimates below, PRDO derives ~23% of its CTU and AIU revenue as of Q3’25 from graduate students. We believe PRDO will have to cut graduate tuition in response to its competitors to prevent further enrollment pressure.

Based on PRDO’s existing cost structure, we estimate each 2.5% cut in tuition rates has a ~$1M impact on its operating earnings across both institutions, with a greater effect on AIU due to its heavier graduate population mix:

PRDO’s historical normalized trading multiple is roughly ~8x NTM P/E.

Combining our estimate of 2026E PRDO earnings excluding ghost students, the range of potential tuition discounts, and the historical normalized multiple, we arrive at a PRDO price target of ~$14-$16, or 48% to 55% downside.

Conclusion

PRDO management has celebrated the company’s extraordinary run of enrollment and retention growth as the product of student interest, operational refinements, and a sprinkle of generative AI magic. We believe the truth behind the halcyon numbers reported by PRDO, and the for-profit education sector in general, hinges on enrollment fraud, which should be highly concerning to PRDO shareholders and management.

When, in 2024, PRDO’s enrollment trajectory broke sharply from its historical pattern, it accelerated to levels that defied management's expectations just one quarter prior. Nothing meaningful changed in the macro environment to justify a sudden surge of Americans eager to return to for-profit online universities. There was no labor force shock, no cultural shift in student behavior, and certainly no renaissance of academic aspiration. What did change, however, was the scale, sophistication, and ease of ghost students enrolling to get access to the federal financial aid pipeline. The results over the last two years have been a transfer of wealth from U.S. taxpayers to PRDO shareholders and management and the for-profit education industry as a whole.

The period in which PRDO’s growth went vertical coincided with the explosion of synthetic enrollments across U.S. higher education. Multiple reports describe massive fraud rings using stolen identities, AI-generated coursework, and FAFSA loopholes to extract federal financial aid by masquerading as real students. Our investigation revealed that PRDO’s front-end defenses were practically nonexistent: fictional personas, cartoon characters, and blatantly unrealistic applications easily navigated the admissions funnel and got enrolled, immediately directed toward federal aid paperwork. This was not a one-off glitch; it was a systemic failure of basic identity verification controls at PRDO, which derives ~71% of its revenue from federal Title IV funding.

For-profit universities like PRDO were uniquely exposed and uniquely incentivized to benefit from this surge. Ghost students impose minimal academic burden, boost enrollment and retention KPIs, and deliver high-margin federal aid dollars. Management’s attribution of this growth to “enhanced student engagement” and “technology investments” rings hollow in light of the ED’s actions and the industry’s sudden reversal.

The federal government has shut this door. Starting in late 2025 and escalating through 2026-2027, the ED is implementing mandatory identity verification on FAFSA applications and shifting the accountability back to schools. Q3 2025 earnings reports by peers confirm the impact: new student trends are weakening, marketing spend is rising to chase “real” students, and excuses are now piling up on earnings calls, ranging from “marketing execution errors” and “conversion issues” to “temporary enrollment softness.” In reality, the easy money has dried up, and we believe the results will only get worse as these fraud gates continue to close throughout 2026.

PRDO’s management seems, at least on some level, to understand this better than their talking points suggest. Insider selling has been aggressive, with executives unloading nearly half their owned and vested stock over the last twelve months, an unusual move if the business were truly entering a new phase of “sustainable and responsible growth.”

We think the inevitable unwinding has only begun. As identity controls tighten, ghost student enrollments will continue to collapse. As FAFSA renewals require additional verification, ghost students already in the system will be removed. Retention numbers will break. Operating leverage will reverse. With a larger fixed cost base, now burdened by the USAHA acquisitions, we expect severe 2026 earnings compression for PRDO.

The ghost students are leaving, taking phantom enrollment growth with them. And we believe PRDO, like the broader for-profit sector, now faces the uncomfortable reality of competing for real students in a shrinking, overserved market with no tailwind of fraudulent aid dollars masking its structural weakness.

We think investors relying on the past two years of “record performance” as a baseline for PRDO’s future are mistaking a bubble for a business model, as federal intervention is now exorcising the specter that inflated PRDO’s results. We believe that the lights are flickering on, leading the growth story to disappear alongside the ghosts.

Terms of Use

Use of reports prepared by Bleecker Street Research LLC (“BSR”) and this website is subject to and governed by the below Terms of Use (the “Terms”). The Terms govern all reports published by BSR (each a “BSR Report”) and supersede any prior Terms of Use governing the access and use of this website and BSR Reports, which you may download from this website. By downloading, accessing, or viewing any materials on this website, you hereby agree to the following Terms.

Bleecker Street and Its Related Parties

BSR is under common control and affiliated with Bleecker Street Capital LLC (“BSC”), Bleecker Street Capital Management LLC (“BSCM”), and affiliated funds, including but not limited to Bleecker Street Minerva LP (“Minerva”) and Bleecker Street Partners LP (“BSP”) (collectively, BSC, BSCM, and affiliated funds, including Minerva and BSP, are referred to herein as “BSC”). BSR is an online research publication that produces due diligence-based reports on publicly traded securities, and BSC and BSCM are investment advisers registered with the U.S. Securities and Exchange Commission. The reports on this website are the property of BSR. BSR and BSC, collectively with their respective affiliates and related parties, including, but not limited to any principals, officers, directors, employees, members, clients, investors, consultants and agents, are referred herein to as “Bleecker Street”, “us”, or “we”.

BSR is a for-profit journalistic organization that researches and provides opinion journalism about issues of concern to the general public, including about the securities of public issuers. BSR finances its journalism through a non-traditional revenue model where it earns revenue from positions that BSC takes in the securities of issuers on which BSR reports. This business model requires Bleecker Street to take material financial risk, which our partners have exposure to. To manage risk, we must close open positions as we deem prudent. We do not provide “price targets” for securities, although we may express our subjective opinion of the value of a security, which differs from a price target in that we neither know nor claim to know how the market might value such security. We therefore typically do not hold, and provide no assurance that we will hold, a position in a reported-on security until it reaches a price target, nor do we necessarily hold, or provide any assurance that we will hold, positions in securities until such securities reach the price that reflects our opinion of value. Many factors enter into investment decisions aside from opinions of the value of the security, including without limitation, borrow cost, “short squeeze” potential, risk sizing relative to capital and volatility, reduced information asymmetry, the opportunity cost of capital, client expectations, the ability to hedge market risk, our perception of the efficacy of market regulators and gatekeepers, our perception of the resource imbalance between us and any Covered Issuer (defined below), and our subjective perceptions. Therefore, you should assume that upon publication of a report, we will, or have begun to, close a substantial portion – possibly the entirety – of our positions in the Covered Issuer’s securities.

Reports Are Solely Attributable to BSR

The BSR Reports on this website are opinion journalism. On this website and through the BSR Reports, BSR is providing its journalistic opinions about issues of concern to the general public. You understand and agree that the opinions, information, and reports set forth on this website are attributable only to BSR, which bears sole responsibility for the information on this website and content of the BSR Reports; provided, however, that persons affiliated with Bleecker Street have provided BSR with publicly available information that BSR has included in the BSR Reports and on this website, following BSR’s independent due diligence.

Website and Report Use Is at Your Own Risk

Any and all use of BSR’s research and BSR Reports is entirely at your own risk. Neither BSR nor BSC is liable for any losses or damages you may incur as a result of your use of this website, including but not limited to any direct or indirect trading losses you may incur as a result of any information on this website, any BSR research, or any BSR Report. You agree to do your own research and due diligence with respect to any information on this website, and to consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities of an issuer discussed on this website (a “Covered Issuer”).

BSC’s Trading Practices and Positioning with Respect to Covered Issuers

As of the time and date of each report, BSC (defined below) is short the securities of, or derivatives linked to, the securities of the Covered Issuer, unless otherwise stated in the report. BSC therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Upon the publication of each report, we may cover, and typically will cover, a substantial majority of our short positions. BSC’s covering its short positions upon the publication of a report is not a reflection of a lack of conviction in any opinions or the facts presented on this website or in any BSR Report. Rather, the act of covering BSC’s short positions upon the publication of a BSR Report is intended solely to manage risk in a prudent manner, consistent with the obligations of a fiduciary of our investors’ money. BSC are likely to continue transacting in the securities of Covered Issuer for an indefinite period after a report on a Covered Issuer, and we may be net short, net long or neutral positions in the Covered Issuer’s securities after the initial publication of a report, regardless of our initial position and views herein.

Notice to UK Residents

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO (each a “Permitted Recipient”). In relation to the United Kingdom, the research and materials on this website are being issued only to, and are directed only at, persons who are Permitted Recipients and, without prejudice to any other restrictions or warnings set out in these Terms of Use, persons who are not Permitted Recipients must not act or rely on the information contained in any of the research or materials on this website.

No Recommendation or Solicitation; No Warranties

All information and opinions on this website and in BSR Reports are for informational purposes only. You understand and agree that no information on this website or in any BSR Report is investment advice or a recommendation or solicitation to buy securities. In any given BSR Report, BSR is solely articulating its reasons at the time of publication for the positions it may have in the securities of a Covered Issuer. To the best of BSR’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities of a Covered Issuer or who may otherwise owe any fiduciary duty or duty of confidentiality to the Covered Issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied. BSR makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition, and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets, and liabilities. Such statements, estimates, projections, and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond BSR’s control. All expressions of opinion are subject to change without notice, and BSR does not commit to update or supplement any BSR Report or any of the information contained therein.

All Materials Copyrighted; Permitted Sharing

The information on this website, including but not limited to BSR Reports, are copyrighted and the intellectual property of BSR. You agree not to distribute any of the information on this website, whether as a downloaded file, a copy, an image, a reproduction, or a hyperlink to such file, in any manner other than by providing the following hyperlink: bleeckerstreetresearch.com. If you have obtained research published by BSR in any manner other than by downloading a file from the foregoing link, you hereby are on notice of these Terms, agree to these Terms, and agree not to use such research in a manner inconsistent with these Terms.

You further agree that you will not communicate or distribute the contents of BSR Reports and any other information on this site to any other person unless that person has agreed in writing to be bound by these Terms. You understand and agree that if you access this website, download or receive the contents of BSR Reports or other materials on this website as an agent for any other person, you are binding your principal to these Terms.

Limitation of Liability; No Special Damages

Bleecker Street shall not be liable for any claims, losses, costs, or damages of any kind, including direct, indirect, punitive, exemplary, incidental, special or consequential damages, arising out of or in any way connected with this website or the BSR Reports. This limitation of liability applies regardless of any negligence or gross negligence of Bleecker Street. You accept all risks in relying on the information and opinions in any report on this website.

Governing Law; Jurisdiction; Arbitration

You agree that any dispute between you and Bleecker Street arising from or related to these Terms, the information on this website, or any BSR Report shall be governed by the laws of the State of New York, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the state and federal courts located in New York, New York and waive your right to any other jurisdiction or applicable law. You agree that any dispute between you and Bleecker Street arising from or related to these Terms, the information on this website, or any BSR Report shall be brought exclusively in binding arbitration conducted in New York, New York by JAMS, before a single arbitrator, under the applicable JAMS rules. You agree that you waive the right to a trial by jury in any action or proceeding in any jurisdiction between you and Bleecker Street.

No Waiver; Validity

The failure of Bleecker Street Research LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to the foregoing governing law and jurisdiction provision.

One-Year Limitations Period

You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to the use of this website or the material herein must be filed within one year after such claim or cause of action arose or be forever barred.