PureCycle: “It Looks As Bad As It Smells”

Introduction

Two weeks ago, we published an initial report on PureCycle Technologies (PCT), demonstrating that the company’s Ironton facility in Ohio was operating at a substantially lower level than expected by the market. On the November 8 earnings call, PureCycle conceded production shortfalls and disclosed a planned two-week shutdown in the second-half of November to make a multi-million dollar repair.

Immediately following our report, in an apparent attempt at misdirection, PureCycle announced it had made its first shipment to Formerra. This press release (notably not an 8-K) prompted a 15% gain on the day.

The excitement was short-lived, when PureCycle reported earnings on Tuesday night, it announced it had only “processed” 409,000 pounds of feed, producing just 100,000 pounds of pellets (implying less than 25% yield). It also disclosed that it was shutting down the facility to make a multi-million dollar last-minute design change.

PureCycle has faced a string of operational issues since the commencement of the Ironton project, in part due to “the war in Ukraine, COVID-19, supply chain issues, and low water on the Mississippi River,” among other things. The PureCycle faithful believe that these issues are behind them and that PureCycle is on the precipice of becoming the world’s pre-eminent supplier of recycled polypropylene.

Since the force majeure claim following the power going out, bulls have been waiting for production to begin. Now PureCycle is on the verge, but first it has to stop everything for two weeks and fix one more thing. Then, it will begin a sprint into year-end, it must run at 50% of nameplate capacity in December and 100% by April to avoid default.

Unlike many pre-revenue companies, missing these milestones is a real problem. That is because PureCycle has financed much of its facility with debt, and the terms of this debt are onerous. More than just missing guidance, if PureCycle is not able to run at 50% of nameplate capacity in December, we believe that could be the spark that lights the tinderbox of PureCycle’s debt-heavy capital structure.

Disclosure: We remain short shares of PureCycle Technologies (PCT), please see full disclosure below.

Key Points

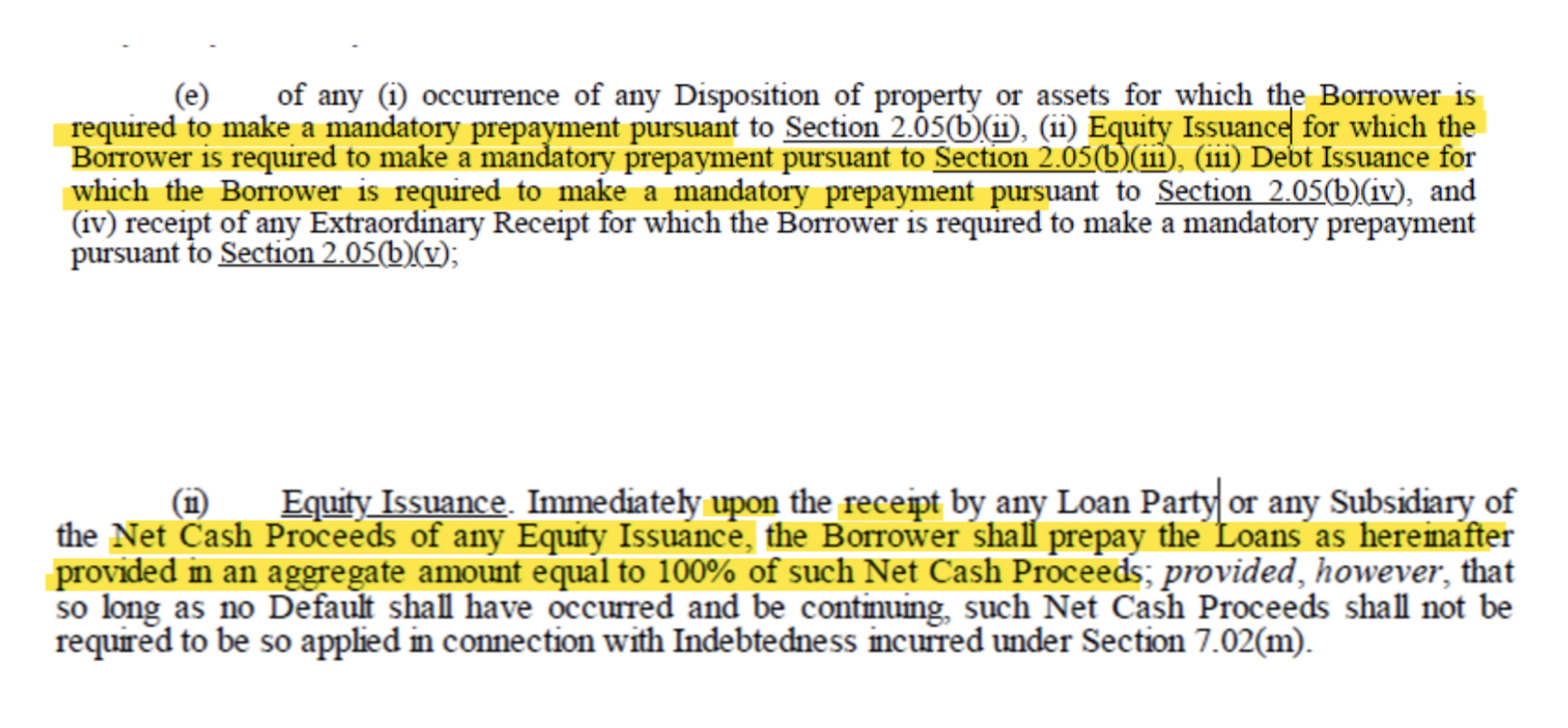

PureCycle’s market cap is currently $640 million, with an enterprise value of ~$1 billion. Everything is collateralized, even future equity and debt issuance has to pay back bondholders first. We believe the equity is a zero.

PureCycle is encumbered by brutally constrictive municipal debt. PureCycle’s municipal bonds require the company to hit 4.45 million pounds of production (50% of nameplate capacity) over one month by December 31, and 100% by April 2024. We do not believe PureCycle will be able to achieve these numbers, putting the company at risk of imminent default.

All assets of the Ironton project, inclusive of the IP license from P&G, feedstock and offtake agreements and any and all revenues derived from the project are collateralized against the Ironton bonds.

PureCycle has already been so close to default on Ironton bond obligations that its largest shareholder, Sylebra Capital, had to provide it with a $150mm revolving credit facility to facilitate a default waiver.

PureCycle lost two key feedstock agreements, which have been replaced with an inferior quality feedstock contract. Likewise, the company has had to replace a key offtake agreement with a contracted partner who isn’t obligated to take any of the plant’s pellets for at least 6-12 months.

PureCycle’s investors believed the company’s Ironton, Ohio plant was operating at higher rates than it has been. PureCycle has so far been able to produce 100,000 pounds of pellets from 409,000 pounds of feed processed. What has been produced does not meet the terms of PureCycle’s offtake agreement.

Despite this, holders of PCT’s common equity are relying on the company producing nearly 150,000 lbs per day in December, immediately following a two-week shutdown and facility design change in order to escape impending default.

During its sprint to achieve this milestone (and the all important equity unlock for management and legacy shareholders) PureCycle has lost its Senior Health and Safety Manager and Lead Mechanical Integrity Engineer.

Third-Party Construction Monitor reports show that milestones that should have occurred in the week following the initial production run in June are now over 130 days behind schedule, with the most complex deadlines remaining. A separate independent engineering report projects that it will take 9-12 months to get from initial commercial production to full-scale, mature production.

If PureCycle is unable to sell Procter & Gamble polymer at “petro-competitive pricing,” its licenses to its core IP become non-exclusive, meaning any aspiring polypropylene recycle could license the IP that is core to PureCycle’s existence as a company.

We suspect management’s refusal to discuss butane as its solvent in the recent earnings call is due to its concerns that its bonds may not be entitled to ‘green’ status if the company is burning millions of pounds of this carbon-intensive fossil fuel each year.

Given the points above and the facts outlined in this report, we believe PureCycle is at risk of imminent default, and that the value of assets attributable to common equity holders in a default scenario is effectively zero.

How PureCycle’s Equity Could Wind Up Worthless

PureCycle raised $250 million through a municipal bond offering issued by the Southern Ohio Port Authority that supported the pre-revenue company to go public in 2021 and allowed construction to begin on the Ironton plant. However, years later, the municipal bond now hangs like a noose around the company’s neck. A deep-dive into the full capital structure of the company shows just how little there is left for equity holders.

Ambitious assumptions made by the company relating to production output in its municipal bond offering documents, namely feedstock quality, plant uptime and polypropylene recovery rates leave PureCycle with little margin for error in meeting looming bond covenants.

The production rates of polypropylene embedded in these milestones (and default waiver covenants) are based on several key assumptions detailed in the Independent Engineer’s Report, part of the Official Statement of the municipal bond offering.

The 107.6 million lb/yr polypropylene production rate relies on several key factors:

An availability factor of 90%, based on planned downtime of 7.75% (504 hours/year) and unplanned downtime of 4.25% (372 hours/year)

A 90% polypropylene recovery rate from an annual feedstock processing rate of 119.4 million lb/yr

A feedstock containing 93.3% polypropylene

Any deviation below these parameters would see the Ironton facility fail to meet its production capacity targets, putting PureCycle in technical default on the Ironton bonds.

Detailed analysis of the various debt instrument documents and related disclosures leads us to believe that PureCycle is already operating below these parameters.

PureCycle’s cash balance was just $28 million at the end of the second quarter before the company raised $250 million through the issuance of a convertible bond. PureCycle has its back to the wall. We think the choice to issue convertible debt was a mechanism to bring cash onto PureCycle’s balance sheet without drawing on Sylebra’s revolving credit facility. In fact, PureCycle had to amend its credit agreement with Sylebra to issue these securities. Unlike most companies facing a liquidity crunch before generating revenues, PureCycle is unable to raise equity or more debt. The proceeds of any equity issued must immediately go to the lenders of its revolver and the $40 million Pure Plastic loan, both of which contain identical clauses.

We think common equity holders should ask themselves: with the vast majority of the company’s assets, including its intellectual property license, held as collateral by its creditors, what is it they actually own?

PureCycle is now a distressed debt story. There is a total of $539.55 million of debt outstanding (greater than the current PCT market capitalization) across the following facilities::

$250 million in mortgage-backed revenue bonds issued by the Southern Ohio Port Authority (SOPA), a government entity.

$250 million in Green Convertible Notes (which are unlikely to be converted at the $14.82 strike price)

$40 million term loan facility from Pure Plastics LLC (an entity controlled by Dan Gibson of Sylebra)

An undrawn $150 million revolving credit facility from Sylebra Capital and affiliated entities.

Regarding specific covenants, the loan agreement relating to the municipal bond issue is rigid and unforgiving. PureCycle is required to maintain a senior debt coverage ratio of at least 150% and a 110% net income ratio available for subordinate debt service. Cash on hand must be at 75 days or greater, and any Liens and Encumbrances must be discharged promptly by the company.

Perhaps most tellingly, all revenues booked by PureCycle must be deposited into an “Operating Revenue Escrow Fund.” Ongoing budget expenditures for everything from payroll to reimbursing contractors and buying inventory must be approved by the Bond Trustee.

While bond covenants cause many market observers’’ eyes to glaze over, these conditions are striking in the scope and control bondholders have over day-to-day operations at PureCycle. As we briefly described in our previous report, ongoing failures by the company have caused two limited waivers to be drafted and signed. After triggering default for failure to complete construction, PureCycle was granted a default waiver in March, allowing them to avoid default by hitting 50% factory output by September 30 and 100% output by December 31. After failure to meet these conditions, the company defaulted again in September and operational dates were pushed back by three months.

We’ve seen social media discourse on PureCycle; bulls are convinced that another default in December would just lead to another waiver. We’d caution such optimism; bondholders have a habit of forcing recovery as soon as they think there is no more blood to be squeezed from the proverbial stone. The Bondholders certainly haven’t forced PureCycle to deposit $150 million (a 60% cash security) into a Trustee account because they trust PureCycle management will deliver this time around.

Betting Against Recycling Factories With Municipal Financing Is Like Shooting Fish In A Barrel

We came across this table showing nearly every single municipally financed recycling project over the last ten years. PureCycle NOT defaulting would be a historical anomaly.

Given the near 100% default rate for projects post-construction, it’s not hard to see why such restrictions were placed on PureCycle at issuance. But beyond the headline financial covenants, nearly everything owned or receivable by PureCycle Technologies, LLC and PureCycle: Ohio, LLC, nailed down or not, is collateral for the bond issuance, even the spare parts:

Collateral:

Technology License from Proctor & Gamble

all Accounts;

all Chattel Paper;

all Copyrights, Patents and Trademarks and all License rights of the Debtor therein;

all Documents;

all Equipment;

all Fixtures;

all General Intangibles and all of Debtor’s rights and remedies under, and all moneys and claims for money due or to become due to Debtor under, any Assigned Contracts;

all Goods;

all Instruments;

all Inventory;

all Investment Property;

all cash or cash equivalents

all letters of credit,all Deposit Accounts with any bank or other financial institution;

all Commercial Tort Claims;

all Assigned Contracts;

all property and interests in property of Debtor

all O&M and asset management agreements;

utility interconnection, service and maintenance agreements;

existing surveys related to the Project;

all change orders, operating instructions, and as-built surveys in connection with the Project and any Capital Additions;

equipment and performance warranties;

final engineering and design documentation;

all plans, specifications, drawings, purchase orders, reports and permits in connection with the Project and any Capital Additions;

shop, vendor and training manuals;

operating procedures and programs, including those in connection with the operation and maintenance of the Facility and each Capital Addition;

all payment and performance bonds and surety agreements in connection with the Project and any Capital Additions;

project Fund requisitions and backup; and

spare parts.

PureCycle needs to produce 4.45 million pounds of UPR resin for a month to meet its next bondholder milestone. But it’s not as simple as bulls would like to believe. A careful review of PureCycle’s supply agreements show supply quality commitments have worsened. Meanwhile, PureCycle’s offtake agreements with Formerra require PureCycle to produce FDA-specification pellets from drinking cups, a product PureCycle has been yet to be able to manufacture. Crucially, the Formerra offtake agreement does not meet the terms of the first waiver.

PureCycle’s Formerra Offtake Agreement Does Not Meet The Terms Of Its First Waiver

Hours after our first report on PureCycle, the company announced it had made its first commercial shipment, with offtake partner and distributor Formerra picking up a truckload of pellets from the factory. The news was enough to send shares 15% higher on the day. But the devil is in the details, and the relationship between the quality of offtake agreements and PureCycles bond covenants is worthy of more attention.

While longs were excited by the news of the first truck of pellets being taken away by Formerra, we believe PureCycle’s offtake agreement with them DOES NOT meet the terms of its first default waiver.

Formerra is the replacement offtake partner for the company, after Ravago, the company’s first feedstock supplier and offtake partner at the time of 2020 bond issuance. Ravago sent PureCycle a notice of default and terminated its agreements with the company in September 2020.

Ravago claimed PureCycle had “failed to produce samples of the product,” “failed to maintain a safety-stock of inventory materials,” and had further breached the agreements through a “unilateral change to the Product specifications.”

“How A Feedstock Supplier Dumps You”

Because PureCycle has collateralized all of its offtake and supply agreements under the Municipal bond issue, the company was obligated to find replacement contracts to not default on sufficient collateral terms in the bond.

Ravago’s canceled deal was replaced with a Distribution and Offtake agreement with Formerra, a chemical logistics company. The headline number for the offtake portion of the Formerra agreement appears to be a reasonable substitute for the lost Ravago contract, with a 15 million pound minimum and a 40 million pound maximum of annual offtake.

That is until you compare the specifications PureCycle must meet to trigger Formerra’s obligation to purchase or accept any product at all. Despite the goodwill Formerra demonstrated in agreeing to accept a truckload of post-industrial recycled pellets from PureCycle to allow it to make its press release last week, Formmera is not obligated to accept any shipment from PureCycle (which in any event shall be delivered by rail and not truck, per the agreement) from PCT unless the product is: produced from drinking cup feedstock (per PCT’S FDA NOL) and certified by APR as post-consumer derived material.

PCT does not presently have APR certification, a process that requires 6-12 months of data to be submitted prior to a verification audit.

Given the requisite product specifications before Formerra is obligated to take any product have not been met, we pondered why Formerra appeared so willing to act as the face for PureCycle’s “First Production” PR event, days before PureCycle released disastrous operating conditions on earnings.

The only outside partnerships listed on Formerra’s Press Release page are PureCycle and similarly distressed de-SPAC bio-plastics company Danimer Scientific.

Danimer Scientific (DNMR) shares a lot of similarities to PureCycle. Both companies are trying to do something a new way, and incidentally, both are relying on a license from Proctor and Gamble. Danimer Scientific also went public via SPAC, promising a massive near-term ramp in revenue and production that has yet to materialize. One advantage Danimer Scientific has over PureCyle is that it is not beholden to restrictive municipal bond covenants as is the case with PureCycle. Danimer Scientific shares are down 97.5% from its 2021 highs, and the company is currently worth about $150 million. PureCycle’s market cap currently stands at approximately $630 million.

Danimer Scientific’s Stock Chart:

The bond waiver required PureCycle to replace Ravago’s deal with “a substantially similar” offtake agreement, but given the limited and specific products Formerra is required to accept, we question if this replacement deal will actually provide the level of security the Bond Trustee requires. Without a reliable supply of used drinking cups or the certification needed to enforce such offtake agreements, we expect these problems to manifest if and when PureCycle is able to produce in volume.

PureCycle’s Current Cellmark Supply Agreement Does Not Meet The Terms Of Its First Default Waiver

Following a change in CalRecycle and CARE subsidies relating to polypropylene carpet recycling, another PCT feedstock supplier, Circular Polymers LLC declared force majeure in November 2022 and canceled its feedstock supply agreement. Unfortunately, this loss of supply occurred after PureCycle purchased dedicated carpet extrusion machines from KraussMaffei.

Having lost some of its highest-quality feedstock supply agreements, with subsidy changes negatively impacting access to a high-grade feedstock material in Polypropylene carpet, PureCycle entered into a new feedstock agreement with Cellmark Plastics. The feedstock specifications covered by this agreement are drastically inferior to the agreements it replaced, with feedstock polypropylene percentages ranging from just 50% to 85%, substantially lower than the specifications of any of the agreements summarized in its bond offering documents.

As with the Formerra offtake agreement, this replacement agreement was a lower-quality supply-side substitute. The Cellmark agreement does not appear to meet the terms of its first default waiver.

Replacing a 90-95% polypropylene feedstock in the form of recycled carpet with one that has mixed plastic content is not a “substantially similar” replacement in our view, as required in the Bond waiver. One of the Cellmark feedstocks is up to 50% polyethylene, a plastic that requires labor-intensive separation, often by hand. We struggle to see how this product can be sorted, crushed and prepared for PureCycle’s process without triggering other default conditions that relate to required operating margins.

In fact, PureCycle’s warranty with Koch Modular for the chemical processing unit is voided in the event that the company feeds material into the process that has a Polypropylene content of under 93%. Since the Koch Modular unit is collateral under the Bond, loss of warranty may also trigger default.

Since nearly every monetary agreement signed by the company is collateralized under the bond, any significant change in any supply, offtake, lease, or equipment contract can trigger a domino effect that puts PureCycle in default.

Each outstanding debt facility PureCycle has raised since the municipal bond includes a cross-default clause. Broadly speaking, this means that should PureCycle default on any obligation above a threshold amount defined in each respective credit, indenture or loan agreement, it also defaults on that facility. If PureCycle cannot negotiate a waiver or amendment, that facility may be called.

With several default scenarios on the ironton bonds imminent and btoh Sylebra affiliated lender credit agreements making claim to proceeds from future equity and debt issuances, PureCycle has truly run the well dry in terms of sources of capital.

*Both of these Cross-Default clauses include a carve-out for “ any such Indebtedness or Guarantee evidenced by or made in connection with the Ironton Bonds”

PureCycle’s Third Quarter Operational Update Corroborates Our Initial Report

PureCycle’s 10-Q and earnings call last week did little to bolster investor confidence that it would avoid default in the coming months.

Management effectively validated our assertions regarding minimal production. CEO Dustin Olson’s reluctant admission during the conference call that only 100,000 of the 409,000 pounds of material processed had been pelletized implied just a 25% yield, with no mention of what percentage of those pellets met quality specifications. This alone should provide investors no assurance it can meet near-term Bond Waiver deadlines of 4.45 million pounds per month by December 31 and 8.9 million pounds per month by April 30.

Management conveyed that they expected to scale from this 100,000lb production to 100% capacity inside of a month. The independent engineer’s report stated that the expected time from the first commercial sale (which the company only nominally achieved on November 3rd) to fully ramped, mature production is 9-12 months.

To meet the December 31 production quota,the plant must produce 148,000 pounds daily, for 30 days straight. During the recent earnings call, Olson stated that “we intend that the production post outage to be effectively 100% PCR (Post-consumer recyclable).”

This two-week shutdown has been confidently asserted as a panacea for all of the company’s operational woes. The facility is currently projected to re-enter production startup on November 22, the day before Thanksgiving. Approaching this critical juncture, the company lost its Lead Mechanical Integrity Engineer and Senior Health and Safety Manager, as disclosed in the 10-Q. We do not think these are departures you want as you are ramping up to a make or break company milestone.

We reviewed the Leidos Independent Construction Monitor report from May 2023, which shows specific milestones that must be completed prior to the facility being certified as “Substantially Complete.” The “Initial Production on PCR” event was initially forecasted to be completed just 5 days after the “Initial Production on Post-Industrial feed” event. Substantial completion was projected to occur just 20 days after the initial “Post-Industrial” Feed milestone.

[May 2023 Leidos Construction Monitoring Report]

The company has only explicitly disclosed completion of the Solvent Introduction (May 30), Initial Post-Industrial (June 20), and Commercial Sale (November 3) milestones, as certified by Leidos.

Specifically, the “start of commercial operations” was designated in this report as the first sale of product, which was projected to be completed on May 6, the same date as the Initial Post Industrial Feed production date. The company didn’t complete a sale until November 3, or 136 days behind its claimed production date, again on June 20.

We asserted in our previous report that the initial production run on June 20 was from reprocessed and re-extruded virgin pellets. The construction monitor report appears to confirm this, with initial production explicitly labeled as from “Virgin” feed.

PureCycle’s Butane Bungle

In our initial report, we raised the point that PureCycle’s solvent is “nominally 100% butane”. On PureCycle’s conference call, a sell-side analyst with a chemical engineering background inquired about the solvent, noting “I’d like to think there’s much more to it than that.”

Olson dodged the question, saying: “with respect to the comment on butane and so on, I’m really not going to get into the details of our solvent.”

Olson didn’t need to get into the details. The independent construction monitors’ report provides additional confirmation that its solvent is butane. Indeed, it helpfully provides pictures of PureCycle’s butane storage area and PureCycle receiving delivery of butane.

PureCycle increased butane solvent combustion by 16x between 2021 and today, undermining solvent recycling claims

In the earnings call last week, Dustin Olson pushed back on the idea that there was significant environmental impact from the Ironton site. As Olson put it:

“when it comes to the environmental footprint around the site. I mean we have a solvent purification system that recycles solvent, it is reused as a solvent over and over and over.”

This claim contradicts documents filed with the state.

In an August 2021 submittal to the Ohio EPA, PureCycle projected that the Ironton plant would combust 140.816 tons (281,632 lb) per year of butane solvent. All of this material would be burned at the facility flare.

In January 2022, PureCycle sent in a modified permit application that included the addition of another combustion control device, the thermal oxidizer we showed in our previous report. A 2023 permit renewal now shows an annualized average flow rate of 532.36 lb/hr of butane flow to the flare and thermal oxidizer; this is 4.66 million pounds of butane combusted per year, assuming 90% plant uptime (which as we stated earlier is needed to hit production target bond covenants).

[actual annualized flows from permit renewal, September 6, 2023, includes 10% downtime]

[summary of vented emissions for combustion, from September 6, 2023 permit renewal application, PTE/100% uptime]

Per regulatory filings, PureCycle increased its projected solvent combustion from 2021 to now by 16.6 fold. On a purely carbon basis, this increase would account for a 7,606 ton increase in CO2e footprint from the facility.

Conclusion

PureCycle is yet another of the flurry of pre-revenue SPACs to hit the markets in recent years. Unlike most of these, PureCycle also managed to weigh itself down with a debt riddle balance sheet with debt outstanding surpassing its market capitalization and increasingly restrictive municipal bond covenants and if negotiates its way out of one default and into the next.

Ultimately we think PureCycle’s equity is destined for the dumpsters from which it sources its feedstock (but sadly not enough drinking cups).Godot isn’t coming.

PS: PureCycle running the factory to avoid default could trigger an event that massively dilutes shareholders. Until next time.

Bleecker Street Research LLC Terms and Conditions

By downloading from or viewing material on this website you agree to the following Terms of Service. Use of Bleecker Street Research LLC’s research is at your own risk. In no event should Bleecker Street Research LLC or any Bleecker Street Research LLC Related Person (as defined hereunder) be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities of an issuer covered herein (a “Covered Issuer”).

As of the publication date of Bleecker Street Research LLC’S report, Bleecker Street Research LLC Related Persons (along with or through its members, partners, affiliates, employees, and/or Bleecker Street Research LLCs), clients, and investors, and/or their clients and investors have a short position in the securities of a Covered Issuer (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Bleecker Street Research LLC and Bleecker Street Research LLC Related Persons are likely to continue to transact in Covered Issuers’ securities for an indefinite period after an initial report on a Covered Issuer, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in the Bleecker Street Research LLC’S research. One or more Bleecker Street Research LLC Related Persons have provided Bleecker Street Research LLC with publicly available information that Bleecker Street Research LLC has included in this report, following Bleecker Street Research LLC’S independent due diligence.

Research is not investment advice nor a recommendation or solicitation to buy securities. To the best of Bleecker Street Research LLC’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities of a Covered Issuer or who may otherwise owe any fiduciary duty or duty of confidentiality to the Covered Issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Bleecker Street Research LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition, and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets, and liabilities. Such statements, estimates, projections, and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Bleecker Street Research LLC’s control. All expressions of opinion are subject to change without notice, and Bleecker Street Research LLC does not undertake to update or supplement this report or any of the information contained herein. You agree that the information on this website is copyrighted, and you, therefore, agree not to distribute this information (whether the downloaded file, copies/images/reproductions, or the link to these files) in any manner other than by providing the following link: Bleecker Street Research LLC bleeckerstreetresearch.com The failure of Bleecker Street Research LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to the use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Bleecker Street Research LLC Related Person is defined as: Bleecker Street Research LLC and its affiliates and related parties, including, but not limited to, any principals, officers, directors, employees, members, clients, investors, Bleecker Street Research LLCs, and agents.