NextNav (NN): Geolocation Data Firm Navigating Into Choppy Waters

Key Points

NextNav is a sixteen-year-old company trying to build a better alternative to GPS with little meaningful traction.

Despite raising $270 million as a private company, NextNav had not generated any meaningful commercial traction, and in mid-2021, it found itself on the brink of bankruptcy.

It was taken public by a BRiley SPAC that infused the company with $400m and aligned the company with selling real estate in the Metaverse, self-driving cars, air taxis,

NextNav aligned itself with real estate in the Metaverse, self-driving cars, and flying cars, despite promising it would end 2021 with “meaningful revenue” from the Metaverse, it would not be.

NextNav’s Pinnacle Network is attempting to provide vertical location (z-axis) positioning for an FCC-mandated but long-delayed Enhanced 911 project.

Pinnacle Network requires a sensor to be placed in the device, and we don’t think Google and Apple will allow NextNav into their devices when they each both have a solution that meets or exceeds NextNav’s solution.

NextNav’s TerraPoint Network is an even more ambitious project attempting to replace GPS with a terrestrial network that enables tech like drone delivery and eVTOLs. This will require a massive estimated ~$1 billion infrastructure investment.

With cash declining NextNav took on expensive debt in August 2023, with interest expense nearly double revenue.

How NextNav Ended Up On The Brink Of BankruptcyBut Was Bailed Out By A B. Riley SPAC

NextNav was founded in 2007, attempting to build a better GPS able to locate people inside buildings and in dense city environments. Despite raising $270 million as a private company, NextNav achieved little commercial traction.

By mid-2021, NextNav was on the verge of bankruptcy. In the first half of 2021, the company had generated only $500,000 in revenue while losing $21 million. It had $7.7 million in cash left, with $76 million in debt. Fortunately for NextNav, a B.Riley SPAC infused the company with ~$400 million in cash. The go-public pitch included self-driving cars, evTOLs, and location tracking for Metaverse real estate.Nearly every vertical promoted during the offering has yielded effectively no sales, and 2023 revenue projections of $75 million have resulted in just a grand total of $2.7 million for the first 9 months of this year. Revenues have not only failed to reach lofty goals just two years later but have actually shrunk year-over-year.

NextNav’s sales projections were based on two location services ideas: the Pinnacle and TerraPoint Networks. Pinnacle Network is NextNav’s attempt at providing the vertical location (z-axis) in cell phones. Right now, the only use is E911, an “enhanced” 911 service that can show 911 dispatchers the precise location of the caller. For example, a caller from a Manhattan high-rise could be identified as calling from the twentieth floor. This system relies on a sensor placed in the phone, so far NextNav has announced it has placed these sensors in two different flip phones (you read that correctly). It has claimed that its solution is the best and most accurate way to determine the location of someone vertically, but recent industry studies show both Google and Apple have a more accurate technology.

While the Pinnacle system is able to piggyback off existing networks using existing network connections, the TerraPoint network involves proprietary and expensive build-out. NextNav’s TerraPoint Network is a terrestrial network that will attempt to be a better alternative to WiFi. It will rely on many sensors placed around cities that will enable things like drones and eVTOLs to have better location data. One former employee ballparked the cost of building it out at $1 billion and noting that, so far, the government has put up about $20 million for various projects in this space.

The company, running low on cash again this year, has taken on expensive debt. Its new interest expense will be almost twice its quarterly revenue. We believe NextNav, while not necessarily doing anything wrong at the moment, is substantially overvalued and will not have success in the near or medium term.

Disclosure: Funds managed by Bleecker Street Capital are short shares of NextNav (NN). Please see full disclosure at the end of this article.

NextNav Aligns Itself With A Bunch Of Overhyped Garbage To Go Public

2021 was one of the best times in history to be a company running out of money, as long as you were willing to align yourself with any form of stock promotion garbage. In NextNav’s case it promoted future business lines with eVTOLs, the app economy, autonomous vehicles, etc. NextNav had previously pursued a relatively narrow “better GPS” technology, but supporting the lofty SPAC promises required quick expansion.

In its first several conference calls NextNav would make promises about imminent revenue from using its technology in the Metaverse. This is one way a company trying to build a real-world terrestrial network and place its altitude sensors in phones for an enhanced 911 service could try to generate buzz.

NextNav would not generate any revenue from metaverse real estate nor from air taxis. For a company that prides itself on the precision of its technology, it sure could use some of that technology for its financial projections.

Longs and believers should note what exactly made up NextNav’s revenue forecast. The company’s only real current source of revenue is its E911 segment, which was the smallest segment in its investor presentation. And while SPACs missing the mark on revenue forecasts is certainly nothing new, the breadth and depth of this failure is something to behold:

We can see that in every segment not associated with the E911 service contracts NextNav had in place in 2019, no revenue has arrived at all. No eVTOLs. No cars. No Metaverse. No IoT deals or Data Brokering Deals.

Not only has growth not hit the eye-watering rate promoted by the company when taking capital during the 2021 capital raise, but the company is currently on pace to have negative sales year-over-year, with 2023 revenues down 15% compared to the first nine months of 2022.

The Pinnacle Network: Z-Axis Altitude System Going Against Apple and Google

NextNav’s only real source of current revenue is the Pinnacle Network, which is used to provide z-axis location. In English, that means its technology will be able to locate and estimate your altitude. This is helpful if you are calling 911 from the 20th floor of a high rise in New York, and the first responders need to know not only where you are, but what floor you are on.

As NextNav puts it:

“NextNav Pinnacle leads the geolocation industry in providing precise, highly secure vertical location data – in independent tests conducted by CTIA to measure z-axis capabilities, Pinnacle delivered 94 percent "floor-level" accuracy, a level unrivaled by any other available technology. Traditional two-dimensional GPS services do not provide precise floor level altitude, which can lead to delays in time-sensitive emergency situations.”

An alternate use case described by one former employee was to take this technology to Uber and use it to show if a person was actually in the elevator like they said they were if they were running a few minutes late. But for now, the company is focusing on commercializing its Pinnacle Network solution to help companies meet E911 mandates brought by the FCC.

A proprietary and differentiated version of this technology would require NextNav to place a discreet sensor in your smartphone, something we don’t think Apple or other smartphone makers will be keen to allow when they have technology that can effectively solve this problem. Even former employees agreed that getting the sensors in the phones will be hard to achieve.

The solution in the interim is to use barometric sensor data from handsets and relay this through the network. This solution is not exclusive to NextNav, as relaying the altitude reading from a user’s phone through the internet is neither difficult nor differentiated.

We think that this simple network based solution, not based on NextNav sensors and transmitters may explain why revenue from NextNav’s existing deal with Verizon is already in decline. According to NextNav’s 10-K:

“We are currently providing service to Verizon Communications, Inc. ("Verizon") as a customer for enhanced 911 (“E911”) services… We believe that ramp up of customers using our existing Pinnacle network will support revenue growth over the coming year.”

The FCC has been pushing wireless carriers to add Z-axis capabilities in the interest of public safety and to help first responders. However, they have been fairly tepid about this, and the timing has been slow to roll out and been constantly delayed.

In 2015, the FCC adopted rules for improving E911 wireless location accuracy, including vertical location requirements, by requiring CMRS providers to provide either dispatchable location using the National Emergency Address Database or vertical (z-axis) location information in compliance with a yet-to-be-determined FCC-approved metric FCChas been looking to improve 911 caller accuracy for several years, and in 2019 established a z-axis accuracy metric as plus or minus three meters from the handset for 80% of indoor wireless E911 calls. The proposal sets a deployment deadline of April 3, 2021 for wireless carriers to roll out z-axis technology in the top 25 U.S markets, expanding to the top 50 markets by April 2023, 2023

On June 3, 2021, the FCC adopted consent decrees that effectively provided an extension of one year to the April 3, 2021 compliance date in the top 25 CMA’s, but also required the carriers to begin delivering any z-axis information that was available to them and to provide interim reports on their ongoing testing and deployment efforts.

NextNav’s Is Going Directly Against Google And Apple

NextNav cites a CTIA (Cellular Telecommunications And Internet Association) study in much of its marketing materials, showing that NextNav’s Pinnacle Network is the best vertical positioning geolocation service in the game.

“NextNav Pinnacle leads the geolocation industry in providing precise, highly secure vertical location data – in independent tests conducted by CTIA to measure z-axis capabilities, Pinnacle delivered 94 percent "floor-level" accuracy

NextNav’s SEC filings do note the risk of carries not wanting to use NextNav’s services to comply with the FCC mandate and makes note of competitors that have also met the CTIA and FCC standards. What NextNav doesn’t tell you is that THOSE COMPETITORS ARE APPLE AND GOOGLE. Apple’s Hybridized Emergency Location (HELO) and Google’s Android Emergency Location Service (ELS) both met FCC requirements for E911 services.

While we are currently providing service to Verizon as a customer for E911 services, our ability to sell our Pinnacle service to additional wireless carriers for E911, a service we believe to exceed the current FCC accuracy requirement, is dependent upon the willingness of these carriers to use our service to comply with the FCC mandate. This willingness was impacted by the FCC’s one year extension and may continue to be impacted by the development and testing of competing solutions to our technology. In June of 2022, the CTIA filed a statement with the FCC that solutions provided by certain competitors meet these FCC requirements. If the FCC accepts this statement, then the market for our services for E911 may be reduced. - NextNav Risk Disclosures

Source: FCC

NextNav’s reason for existing is its technology, which needs to be input via a separate device into a phone. And the makers of those devices both have a product that works better than NextNav’s product.

Needless to say, Apple and Google dominate the U.S. phone market, and we don’ think they will cede economics to a newcomer that needs to place a receiver in their phones so that first responders know what floor you are on when you call 911.

Well there is a market for cell phones beyond iPhones and Android in the United States, is NextNav making any traction there?

In January 2023, NextNav announced that a phone produced by Sonim Technologies would contain its Z-axis technology. You might reasonably wonder if the XP3 Plus phone will be a big hit? Well, it’s a $100 flip phone. Sonim Technologies stock has not fared well, nor have their financials.

Why the announcement with Sonim Technologies? On NextNav’s board is Alan Howe, a former B. Riley managing director who serves on several other boards including Babcock & Wilcox, Resonant, Sonim Technologies, and Orion Energy Systems.

Continuing to kill it in the flip phone game, NextNav announced a deal with Iris Flip Phone. We were promised flying cars, and we got some flip phones. Classic SPAC.

TerraPoint Network Has Its Own Set Of Problems

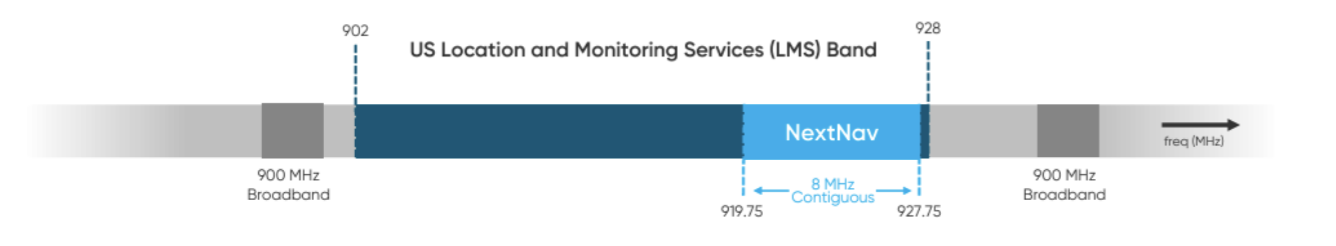

NextNav is also attempting to build its TerraPoint Network, a terrestrial-based network, as a better alternative to GPS based on NextNav’s metropolitan beacon system (“MBS”), this is based on a network of transmitters that broadcast an encrypted PNT (positioning, navigation, and timing) signal based on NextNav’s licensed 900 MHz spectrum.

NextNav owns a lease to operate in the 920-928 mHz band, part of the spectrum reserved by the FCC for Location and Monitoring Services (LMS).

A majority of the rights owned by NextNav are held by the company’s subsidiary Progeny LMS, LLC, which purchased them in 1999 for a net price of $2.4 million.

These leases cover every major economic market in the US, with the exception of Sacramento and Minneapolis, which were terminated by the FCC in 2011 and 2012. Notably, the population covered by these rights is over 90% of the population, but only covers a fraction of the US landmass, as the company does not own rights for a significant number of low-population regions in the country.

These FCC rights must be established by building out transmitting equipment in each of the markets where the company has rights. Put simply, the FCC won't let you sit on a lease and not actually use the spectrum, it’s “use it or lose it.”

NextNav claims this has more benefits over GPS, the system has not been nationally deployed, but there are two test systems in the Bay Area, with limited availability in 83 additional markets in the U.S. NextNav’s plan is to build this nationwide footprint out over the coming years, while not seeing any revenue in the near future (if ever).

Why bother putting a lot of transponders in a city when GPS seems to be getting us from Point A to Point B just fine? Next Nav argues that GPS is not good enough for what we need in future applications such as drones, autonomous vehicles, and things of that nature. NextNav could be right about that, but building out the TerraPoint network will be expensive and comes with diminishing returns on the spectrum.

The Market for TerraPoint Is Small

The GPS network has improved drastically since 1999, when NextNav’s assets were first purchased for Next Gen location services, as evidenced in the technical data collected by Raveon, a manufacturer of industrial remote sensors:

The accuracy has improved on commercially available GPS units since 2009, the end of the data series above, but it’s important to note that in the past 24 years, the devices, antennas and the GPS network itself have improved by leaps and bounds.

For example, Qualcomm’s 8 Smartphone chip now incorporates Trimble’s RTX GNSS correction services built in, allowing for a 1 meter accuracy in position using just GPS and Trimble’s cloud-based correction service. Qualcomm chips are in 30% of smartphones worldwide. Apple, Mediatek, UNISOC and Samsung chips, which account for the remaining market share.

NextNav’s promise to investors is that they have the solution to next-generation GPS, but the fact of the matter is that since the company’s founding in 2007, Next Generation GPS already happened, and NextNav had nothing to do with it.

With under 1-meter accuracy using just GNSS-corrected GPS data quickly becoming a standard feature, the market potential for a new and disruptive “Next Gen GPS” is brutally competitive at best and likely already out of the reach for NextNav. TerraPoint will require the use of a separate antenna for its signal.

or will require chipmakers to grant firmware-level access to NextNav to calibrate internal radios to decipher altitude.

Further, the IEEE trade group, a not-for-profit entity that writes and implements thousands of engineering and consumer standards has been outspoken in the obsolescence of NextNav’s tech. They wrote to the FCC in 2012 that “We continue to see no evidence that M-LMS (NextNav tech) services are viable technology offerings given the products currently available in the marketplace using low-cost Global Positioning System (“GPS”) alternatives for geolocation services in outdoor applications.”

Regarding NextNav’s technology working where GPS signals cannot reach, IEEE stated: “Indoor location services are currently available that use cellular mobile or Wi-Fi™ technology to improve performance in indoor environments, where GPS isn’t always effective. These approaches use systems and infrastructure that are already widely available. Large-scale deployment of Wi-Fi™ and cellular mobile equipment have already resulted in cost-effective, widely deployed location-based services, and future development of application software is likely to improve present performance over time for indoor environments. “

Keep in mind this was 11 years ago, and 13 years after the initial 1999 purchase of spectrum from FCC for this purpose. Technology has improved by leaps and bounds since. “It is difficult for us to conceive of an M-LMS service using proprietary technology within a specialized spectrum allocation that could compete with services already available using presently available technology in licensed and unlicensed spectrum.”

The FCC allowed NextNav (via entity Progeny LMS LLC) to extend its leases, however, only in the lower B & C blocks. NextNav’s leases in the top priority A block in Minneapolis and Sacramento metros were terminated by the agency, with the remainder allowed to proceed. Since the B & C blocks have to “give way” for A block spectrum, we see this as FCC allowing NextNav to continue their experiment but conceding that NextNav wasn’t perhaps the no brainer best solution the company sells to investors.

Z Marks the spot? Not quite

GPS accuracy with GNSS correction is a solved problem for all intents and purposes, but only on the X-Y plane. The altitude that can be detected by a smartphone using only internal sensors relies on a barometer to read atmospheric pressure. Because of physical limitations in a barometer that can fit into a smartphone, this measurement is fairly accurate, as demonstrated in this 2019 research:

Smartphones released in 2012 (Samsung Note 2) and 2015 (Huawei Mate8) are able to detect altitude within 2.6 meters without fail. For most purposes, this level of accuracy is beyond sufficient. Even in skyscrapers, floor detection would be possible over 90% of the time (assuming 2.0 m accuracy and 14 ft story separation).

Conclusion

We believe that NextNav’s technology, while once promising, is largely in an noncompetitive position. It’s Pinnacle Network is competing across Apple and Google and requires a third-party chip in phones, something we don’t think phone manufacturers want to allow. Its TerraPoint Network requires a massive build out, that is unlikely to happen in the near term. NextNav is a classic example of a SPAC that should not exist.

Bleecker Street Research LLC Terms and Conditions

By downloading from or viewing material on this website you agree to the following Terms of Service. Use of Bleecker Street Research LLC’s research is at your own risk. In no event should Bleecker Street Research LLC or any Bleecker Street Research LLC Related Person (as defined hereunder) be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities of an issuer covered herein (a “Covered Issuer”).

As of the publication date of Bleecker Street Research LLC’S report, Bleecker Street Research LLC Related Persons (along with or through its members, partners, affiliates, employees, and/or Bleecker Street Research LLCs), clients, and investors, and/or their clients and investors have a short position in the securities of a Covered Issuer (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Bleecker Street Research LLC and Bleecker Street Research LLC Related Persons are likely to continue to transact in Covered Issuers’ securities for an indefinite period after an initial report on a Covered Issuer, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in the Bleecker Street Research LLC’S research. One or more Bleecker Street Research LLC Related Persons have provided Bleecker Street Research LLC with publicly available information that Bleecker Street Research LLC has included in this report, following Bleecker Street Research LLC’S independent due diligence.

Research is not investment advice nor a recommendation or solicitation to buy securities. To the best of Bleecker Street Research LLC’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities of a Covered Issuer or who may otherwise owe any fiduciary duty or duty of confidentiality to the Covered Issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Bleecker Street Research LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition, and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets, and liabilities. Such statements, estimates, projections, and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Bleecker Street Research LLC’s control. All expressions of opinion are subject to change without notice, and Bleecker Street Research LLC does not undertake to update or supplement this report or any of the information contained herein. You agree that the information on this website is copyrighted, and you, therefore, agree not to distribute this information (whether the downloaded file, copies/images/reproductions, or the link to these files) in any manner other than by providing the following link: Bleecker Street Research LLC bleeckerstreetresearch.com The failure of Bleecker Street Research LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to the use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Bleecker Street Research LLC Related Person is defined as: Bleecker Street Research LLC and its affiliates and related parties, including, but not limited to, any principals, officers, directors, employees, members, clients, investors, Bleecker Street Research LLCs, and agents.