Energy Vault (NRGV): New Evidence Leads Us To Downgrade This Company To A Middle-School Science Fair Project

Bleecker Street Research issues the following retractions and corrections to its December 2, 2022, report on Energy Vault, following the receipt of additional information. Energy Vault’s full response to the BSR report can be found here.

With the respect to the following statement:

“440 MWh Deal With A Large Western Public Utility: We Think This Is Cancelled”

BSR Retraction / Correction: On December 12, 2022, NV Energy announced that Energy Vault was awarded the project for the 440 MWh Energy Storage System in Nevada. This project, which we previously referenced as the “large western utility” in the

BSR report on Energy Vault, was never “cancelled.” With respect to the following statement:

“More Red Flags: 820MW System In Poland”

BSR Retraction / Correction: Energy Vault has reported that the project in Poland identified by BSR is not the project previously disclosed by Energy Vault. Energy Vault has further indicated that the BSR report is incorrect in both technical characterization and location of the project, and that Energy Vault has been awarded an 820MWh short duration battery storage project in an altogether different European country.

With respect to the following statement:

“Energy Vault Is Conspicuously Absent From All Major Department of Energy

Renewable Projects”

BSR Retraction / Correction: The Department of Energy renewable projects list only identifies the project operator or owner. It does not identify or list the suppliers, vendors or contractors of the project owner. Energy Vault is not the project owner or operator and, as a third party contractor, would not be listed on the Department of Energy website.

Disclosure: Funds managed by Bleecker Street Capital are short shares of Energy Vault. Please see full disclaimer at the end of this report.

Introduction

About ten years ago some people had a new idea to store energy. They took a ski lift, put some bags of gravel on it - creating a device that could generate 50kW of energy. They called their company Energy Cache. Soon after the project was built, the company would shut down.

Several years later Energy Vault was born out of the Energy Cache idea. Out was gravel on a ski lift, in was a crane that would lift massive bricks up and down.

The idea is simple enough. You put a punch of cranes next to a solar plant. At noon when the sun is high in the sky, the solar panels are generating lots of electricity. But then night comes, and the sun goes away. But that’s when you’re home using electricity. This is a well known problem that plagues renewable energy.

Energy Vault’s solution is a gravity storage solution. The suspended bricks are potential energy, and when they are released they will create energy. It’s at least trying to address the problem, but it makes numerous mistakes. And even before Energy Vault went public it was debunked by numerous people.

But the new Energy Vault punched above its weight securing financing from an impressive roster of investors. Its first round of financing came from Cemex - the multinational Mexican construction company in May 2019. It quickly secured a $110 million Series B investment from the Softbank Vision Fund. Back in 2019 that meant something positive, now maybe not so much. Energy Vault’s claim that it was “pioneering a faster journey to the decarbonization of our planet by reducing the cost of abundant clean energy.” This pitch played well with investors at the time, even if many of the assumptions made by Energy Vault defy even an elementary level understanding of physics, engineering, construction, and design.

As alluded, Energy Vault has been fairly thoroughly discredited. Culper Research wrote about the company in May, exploring the legitimacy of a key customer. Keith Dalyrymple wrote about the company, also in August. Prior to going public the Energy Vault idea was discredited by many in the science community.

“Energy Vault was so obviously flawed in so many ways in its first incarnation I didn’t even bother to critique it. I expected it to wither and die” - Michael Barnard April 20, 2022

But that didn’t stop Energy Vault from going public in a $1.6 billion transaction. We desperately wanted to short the stock because, well… come on. But because of SPAC redemptions, there was a low-float and the stock was unshortable. Today, borrow is plentiful. Most prime brokers we spoke to have plentiful borrow in the 5-10% range. Currently sporting a $600 million market cap, we think Energy Vault is set to plunge as several of the key business developments announced by the company do not seem to add up. We are short shares of Energy Vault.

Energy Vault Latest Rally Is Built On A Questionable Foundation

“We are reaffirming our two-year aggregate view of revenue of $680 million through 2023” - Energy Vault November 14, 2022

Energy Vault has a long history of making inflated claims about what will happen with its business. It makes some sense - when your big idea for renewable energy storage can be debunked by a high school physics student - you might be inclined to exaggerate about what is going to happen with the business.

With its stock languishing, we believe that Energy Vault has reported a string of highly misleading news. When Energy Vault reported Q3 earnings it provided the following information:

“We have received awards for approximately 2 gigawatt hours of energy storage solutions to address our customer’s immediate needs. This includes a 500 MWh short-duration battery storage project with Meadow Creek in Australia as previously announced, an 820 MWh short-duration battery storage project in Europe and our previously announced 440 MWh award with a large western utility.” - Energy Vault On November 14, 2022

Source: Energy Vault Q2 Investor Presentation

440 MWh Deal With A Large Western Public Utility: We Think This Is Cancelled

The previously announced project with a “large western public utility” was in Q2 listed as “awarded.” However, in Q3 Energy Vault said the project was still being finalized.

Source: Energy Vault Q3 Investor Presentation

While Energy Vault never named this project, we think we have figured out which project it is. And bad news for Energy Vault, we think it has been canceled. We would encourage everyone to try and replicate our research for themselves.

You can view a list of all the currently planned U.S. energy projects on the Energy Information Administration (EIA) here.

Based on a review of all proposed BESS projects published by the EIA, the only project we could find that meets the size, location, and time frame requirements implied by the Energy Vault announcement is the Dogwood Creek Solar Project in Texas. While we cannot rule out that it is another project, the fact pattern matches and after reviewing every project listed in that database. If it is another project we will happily update our findings.

Source: BESS Database of Energy Projects

On October 25, the Elgin Independent School District rejected the Texas Chapter 313 tax exemption application, effectively killing the project. This came after heavy local opposition to the project.

Energy Vault Announces An Award From An Australian Solar Farm That Doesn’t Yet Exist

After the Dogwood Creek project was effectively canceled, Energy Vault announced a notice of award for a 500MWh project in Australia.

“Developed by Meadow Creek, the 330MW solar farm is located three hours north of Melbourne, Australia and provides zero-carbon electricity to approximately 110,000 homes in the region.”

Does this sound like language discussing a solar farm that doesn’t yet exist? We think it sounds like Energy Vault is claiming they have won an award from a currently operating solar farm, 3 hours north of Melbourne, that is servicing 110,000 homes in the area.

The first red flag is that when you Google “Meadow Creek Solar Farm” nearly all of the results come from the Energy Vault press release. That’s usually not a great sign, especially when you consider that a 330Mw solar farm would be roughly half of all the total solar power generated in Victoria (692Mw). The largest solar facility in Victoria (Karadoc Solar Farm) is a 112Mw. Certainly a project of this magnitude would have some sort of press or media presence.

Continuing our research to the second page of Google, we found a website for the proposed solar project. Proposed! That’s not what we think Energy Vault conveyed in its press release.

We pressed Energy Vault investor relations on the subject and were told that the project was expected to be completed in mid-2024. That is very different from what was said in the press release.

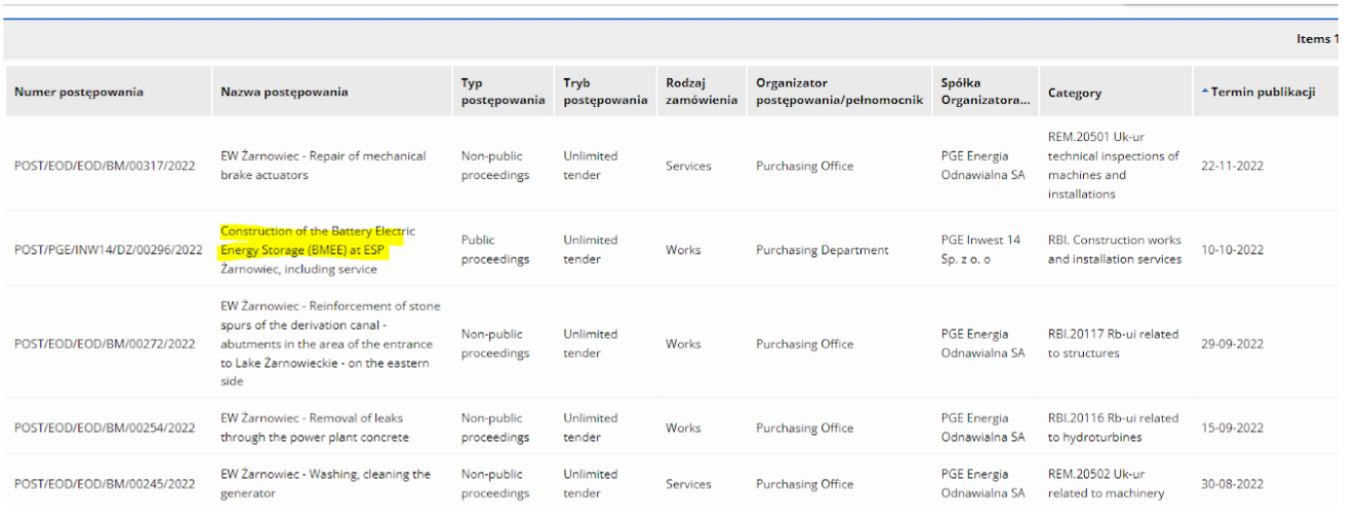

More Red Flags: 820Mw System In Poland

After the Meadow Creek announcement, Energy Vault went on to announce it has been awarded a massive contract to construct a standard Lithium Ion BESS with a “large renewable energy developer” in Europe. An overwhelming amount of European energy storage projects are pumped hydro. There is exactly one project in the Eurozone that has proposed a 820MW system: The Zarnowiec Power Facility, which is owned by the Poland Utility PGE. The next largest project in the European pipeline is a 200MW facility, to give you a sense of the scale of this project.

Energy Vault appears to claim that they have been awarded this project over numerous other well capitalized and experienced competitors. But you won’t believe it, there’s another huge problem.

If we go to PGE’s procurement page, the utility is still accepting bids for the referenced Zarnowiec battery project until November 29.

Unless there is another massive EU energy storage project with no news stories and no listing in the EU energy project tracking database that Energy Vault has been awarded, it appears that Energy Vault has not actually won this project yet.

2.2 GWh With DG Fuels: Half Of Energy Vault’s Backlog Is Riding On This Louisiana SAF Plant

By far the most critical component to Energy Vault’s near term commercial plans is the success of DG Fuels. It is responsible for around half of Energy Vault’s awarded bookings and Energy Vault has said the DG Fuels deal could generate up to $737 million in revenue.

“Additionally, earlier last week, we announced with DG Fuels the doubling of size and increased scope of our previously announced project…In October 2021, we invested alongside Black and Veatch and HydrogenPro in financing round for DG Fuels to support its continued development…DG Fuels and their partners are planning to follow the Louisiana project with additional projects in British Columbia and Ohio, as previously announced, with an opportunity for total storage capacity of 2.2 gigawatt hours overall and up to $737 million in potential revenue over these three projects.” - Energy Vault, May 16, 2022

There is a lot to unpack here!

Energy Vault has proudly displayed this awarded 2.2 gigawatt hour battery storage project since the SPAC transaction was announced. We have done some work on DG Fuels and have concluded that it is not a serious company.

We believe that DG Fuels exists more to release PR statements on behalf of related companies. DG Fuels is a subsidiary of the D’Arcinoff Group, a loose consortium of ex-military mid level officers working out of an office in Washington, DC. This office shares an address with a single employee- maritime lobbying firm and Trafalgar Industries.

For example, in October 2021, we entered into the DG Fuels Agreement, which has the potential to generate up to $520 million in revenue across three projects, the first of which is expected to commence in mid-2022. - Energy Vault S-1

Around or at the same time Energy Vault also invested $1 million into DG Fuels.

In addition, on October 29, 2021, the Company agreed to invest $ 1 million in DG Fuels pursuant to a convertible promissory note with DG Fuels.

The only other announced funding was $3 million from HydrogenPro in the form of a convertible loan. HydrogenPro is publicly traded in Norway with 20 employees according to Bloomberg. HydrogenPro will also serve as a vendor for the Project.

But DG Fuels has estimated that it will cost $3.6 billion to build only the Louisiana facility. So a lot more funding will need to come in.

Now, the Fact that DG Fuels is calling Energy Vault a capital financier of their proposed Sustainable Aviation Fuels facility is a rather large red flag alone, since Energy Vault’s battery to be installed at this facility is the bulk of their 4.2 GWhr install pipeline.

For all practical purposes, DG Fuels’ facility does not exist. A Sustainable Aviation Fuels manufacturing plant is akin to an Ethanol Production plant plus a distillation and refining operation. Construction of this sort of facility is an arduous, multi-year project with planning, permitting, public meetings and state and federal approvals. The simple fact of the matter is that this project is currently but a dream. There are no permitting documents, there are no property records. Nothing. DG Fuels has only a handful of employees on LinkedIn, and it’s all the same cast of characters associated with Trafalgar Industries. There are no engineers, no sales people, no chemists, no HR people and no accountants.

DG Fuels industrial output is merely press releases. Press releases with airlines on future supply agreements. Delta isn’t going to say “no” to a locked-in fuel agreement years into the future, especially if it requires no money down.

The only other flavor of press release from DG Fuels centers on Energy Vault. That’s right, the number one priority of a company that is constructing a petrochemical and fermentation facility is to… secure a backup energy source for operations. Forget distillation columns, industrial heaters, tanks, pipes, fermentation vessels and blending reactors. They’ve got the back up emergency generator figured out and nothing else. It is hard for us to emphasize enough how ridiculous this setup is. DG Fuels is a shell company and it is their 2.2 GWh contract with Energy Vault that represents over 50% of the company’s 4.2 GWhr awarded project pipeline.

Energy Vault Is Conspicuously Absent From All Major Department of Energy Renewable Projects

According to the Department of Energy, there are approximately 280 so-called utility scale grid battery storage projects currently in the works in the U.S. More than half of them are in Texas and California, with a smattering in Hawaii. We have reviewed the dockets for Arizona, Texas, California, and Hawaii through the FERC website, a list that includes RFPs. These states account for 170 of the 280 battery projects. The following companies show up in over 75% of published dockets: NextEra Energy, Tesla, General Electric, Invenergy, and NEC. We didn’t see Energy Vault listed once.

Conclusion

We are short shares of Energy Vault. We think the most recent string of announcements propping the stock up will end up like all the others Energy Vault has made in the past. Energy Vault’s own projections show it will need more capital, and fast. We don’t think the recent projects announced are substantially economic. Energy Vault is now shortable, and we have taken full advantage of this. Projects like these take massive amounts of time and money, and we believe Energy Vault shareholders are in for a rude awakening when it comes time for these projects to actually build.