LL Flooring Holdings (LL): Live Ventures Deal Should Be Treated As Dead On Arrival

Last Wednesday, the 11th, Live Ventures (LIVE) made an unsolicited offer to acquire LL Flooring Holdings, Inc (LL) for an all cash price of $194.4 million or $5.85 per share. This premium of 106% above LL’s current equity valuation resulted in an immediate spike in LL shares, which rose 40%.

LL Flooring (previously known as Lumber Liquidators) has received much scrutiny over the years over the business along with federal investigations and lawsuits regarding residual formaldehyde contamination in the discount Flooring company’s wood based products. The potential suitor (LIVE), on the other hand, is mostly an obscure corporate entity with a market capitalization of just over $80 million.

We have been following LIVE closely for some time, and suspect that the market is not fully aware of the long and sordid past of Live Ventures, but don’t take our word for it - the SEC is seeking to ban LIVE’s CEO from serving as a director of public companies. We see significant, actionable, and near term downside for both LL and LIVE equity and think there is almost no way this unsolicited M&A offer is consummated:

Live Ventures is currently staring down the barrel of a looming court date with the SEC, with the agency asking the court to grant monetary relief as well as a Directors and Officer Ban for LIVE’s CEO, Jon Issac.

Live Ventures CEO Jon Isaac, through an entity he controls, owns 4% of LL shares. If you squint it kind of looks like using an impossible acquisition offer to enrich himself.

As of June 30th, Live Ventures had $3.5 million dollars of cash on hand and net working Capital of $79 million. $114 million of current assets are in net inventories, which are largely consumer and contractor grade building supplies; hardly an easily liquidated asset. Live Venture’s offer proposes the deal as not contingent upon any “financing condition,” which seems impossible given the all cash nature of the offer and the price of $194.5 million

LL management rejected a buyout offer from its co-founder in May of this year, at a price of $5.76. The idea that they would re-consider a similar offer from an objectively inferior would-be purchaser defies belief.

Live Ventures and CEO Issac has successfully delayed court proceedings for an August 2021 lawsuit filed by the SEC, most recently by means of their legal counsel (Paul Hastings LLP) resigning from the case due to “an impasse regarding management of the case and unpaid fees for legal services, which render counsel unable to carry out their duties of representation”

Live Ventures was previously known as Live Deal, a knock off Groupon scheme that we wrote about previously in 2014, which falsely promoted “live coupons” to for restaurants that, when called, had never heard of LiveDeal.

Live Venture’s previous M&A deal, the $84 million purchase of Flooring Liquidators, consummated in January of 2023, has been a disaster, with the projected $125 million in immediate annual top line revenue contribution from the merger resulting in just $37.7 million in revenue for the nine months ended June 30, 2023, compared to $92 million in the previous period.

Initial Disclosure: Bleecker Street Capital is short shares of LL Flooring. Please see the full disclaimer below.

Shares of LL spiked from $2.85 to $4.34 after Live Ventures, Inc. made its non-binding proposal to acquire LL for $5.85 per share in cash. Currently trading at $3.85 per share, the market is clearly skeptical that Live Ventures will be able to close the LL Flooring Acquisition. However, we think the move up could soon fully retrace.

Live Ventures Going Way Back

We know Live Ventures from way back in the day. In 2014, it was known as LiveDeal, and it was a Las Vegas-based company that claimed to be offering “live” coupons for restaurants so they could drive traffic in off hours.

LiveDeal promoted the stock on the radio, online, and everywhere else. Shares soared on the stock promotion. But we called all the restaurants on the LiveDeal platform, and none had ever heard of LiveDeal. The stock promotion ended like nearly all of them do, Live Deal’s shares crashed. Over time LiveDeal would change its name to Live Ventures and acquire a host of businesses, mostly in the flooring industry. But tigers don’t change their stripes, and soon the SEC would come knocking.

Jon Isaac’s SEC Issues

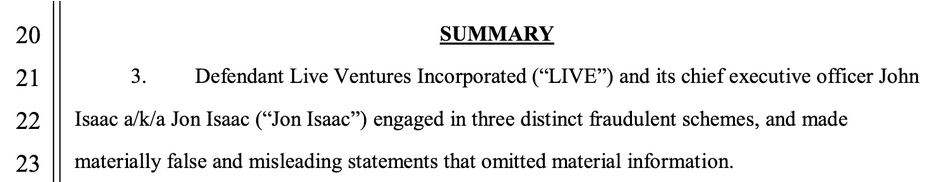

Source: Jon Isaac SEC Complaint

In August 2021, the SEC said that Jon Isaac “engaged in three distinct fraudulent schemes, and made materially false and misleading statements that omitted material information.”

Specifically, the SEC charged LIVE and CEO Jon Issac with fraud associated with a 2016 M&A deal involving LIVE and “Novalk Apps” AND another M&A deal with LIVE and “Appliance Smart) in 2017/2018.

Saying that this company and CEO has a problematic record with fraud and M&A announcements is an understatement (but more on more recent acquisition that is horribly under-performing LIVE’s guidance in a second).

The SEC outlines how the company used misleading announcements and projections on two separate transactions to manipulate shares that he had an interest in higher, enriching himself in the process. The lawsuit points out the lengths Jon Issac has gone to promote these PR announcements with the hiring of of dedicated firms with the explicit aim of pumping the stock.

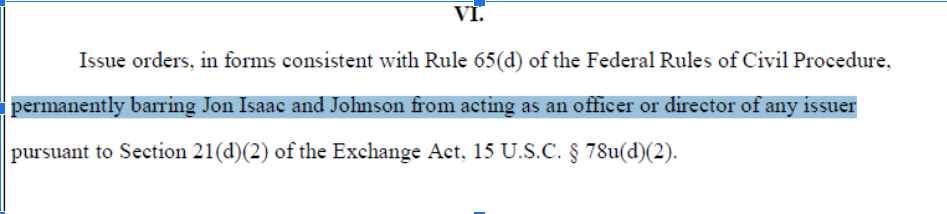

We should point out that the SEC is aiming to extract relief in the form of a lifetime Director and Officer (D&O) ban from the Court:

Live Ventures Acquisition Track Record Includes Massive Misses And Faked Acquisition Dates

In its press release announcing the acquisition Live Ventures claimed to “have a successful track record acquiring historic brands and working closely with existing management teams, boards of directors and large, diverse employee bases.”

Let’s explore this acquisition of Flooring Liquidators, which Live Ventures said would increase revenues $125 million per year.

LIVE claimed in January of this year that the Flooring Liquidators acquisition would add $125 million per year in revenue. However, in its Q2’23 10-Q, LIVE disclosed that Flooring Liquidators had only generated only $37 million in revenue over the last nine months, compared to $92 million in the prior reporting period.

We think LIVE has a tendency to buy melting ice cubes, and we don’t think it can carry on for much longer. SEC’s allegations show that LIVE has been willing to play games regarding acquisitions in the past. Given Isaac’s status as a personal shareholder in LL, using LIVE funds (that it doesn’t seem they have) to make an acquisition that will increase LL’s share price and further enrich Isaac, that doesn’t look good.

LL Flooring Inc Rejected A Similar Acquisition From Its Founder, It Isn’t Going To Accept One From LIVE

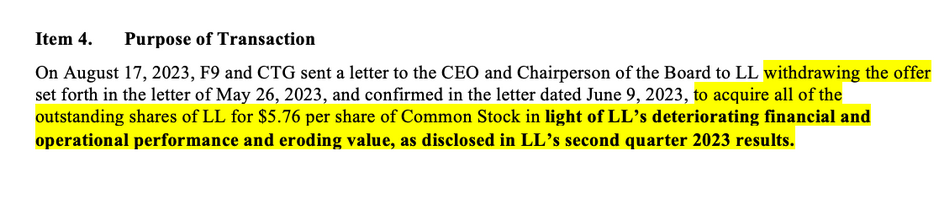

In May of this year, LL Flooring’s founder Tom Sullivan acquired 9.4% of the company. Sullivan was the former CEO, and made an unsolicited offer to acquire LL at $5.76 per share. Despite receiving support from large LL shareholder Howard Jonas, LL did not accept the offer. This was the second time Sullivan had tried to acquire LL, previously failing to do so in 2019. In August, Sullivan officially withdrew his bid, in light of LL’s deteriorating financial situation.

Source: 13-D

We suspect that LL management may not hesitate to shoot down this unserious offer in short order, as Live Venture’s management is facing a D&O ban from the SEC, and they do not have sufficient cash or credit facilities to complete this all-cash, non-financed offer.

Conclusion

There are two problems here.

LIVE’s financial situation (to say nothing of its issues with the SEC) is precarious. It made a large acquisition in Flooring Liquidators that has seen revenue decline massively. LIVE only has $3.5 million in cash, is already 10x levered, and only has ~$32 million in total liquidity. We simply don’t see a world in which it can line up the financing for

LL’s revenue growth has been negative 6 of the last 8 quarters and its losses are ballooning. It has lost $50 million so far this year, and has $7.7m of cash left on the balance sheet. It has the Lumber Liquidators brand, which is worth something. LL’s financial situation is disastrous, and we don’t think LIVE can turn it around.

We believe that LL should fully retrace its move up, and we are short shares of LL.

We are short shares of LL Flooring (LL). We think this acquisition is unlikely to be accepted for a host of reasons, and we think the move up should retrace. We wish we could short LIVE, but the market cap and liquidity are too low.

Bleecker Street Research LLC Terms and Conditions

By downloading from or viewing material on this website you agree to the following Terms of Service. Use of Bleecker Street Research LLC’s research is at your own risk. In no event should Bleecker Street Research LLC or any Bleecker Street Research LLC Related Person (as defined hereunder) be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities of an issuer covered herein (a “Covered Issuer”).

As of the publication date of Bleecker Street Research LLC’S report, Bleecker Street Research LLC Related Persons (along with or through its members, partners, affiliates, employees, and/or Bleecker Street Research LLCs), clients, and investors, and/or their clients and investors have a short position in the securities of a Covered Issuer (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Bleecker Street Research LLC and Bleecker Street Research LLC Related Persons including Bleecker Street Capital LLC are likely to continue to transact in Covered Issuers’ securities for an indefinite period after an initial report on a Covered Issuer, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in the Bleecker Street Research LLC’S research. One or more Bleecker Street Research LLC Related Persons have provided Bleecker Street Research LLC with publicly available information that Bleecker Street Research LLC has included in this report, following Bleecker Street Research LLC’S independent due diligence.

Research is not investment advice nor a recommendation or solicitation to buy securities. To the best of Bleecker Street Research LLC’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities of a Covered Issuer or who may otherwise owe any fiduciary duty or duty of confidentiality to the Covered Issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Bleecker Street Research LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition, and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets, and liabilities. Such statements, estimates, projections, and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Bleecker Street Research LLC’s control. All expressions of opinion are subject to change without notice, and Bleecker Street Research LLC does not undertake to update or supplement this report or any of the information contained herein. You agree that the information on this website is copyrighted, and you, therefore, agree not to distribute this information (whether the downloaded file, copies/images/reproductions, or the link to these files) in any manner other than by providing the following link: Bleecker Street Research LLC bleeckerstreetresearch.com The failure of Bleecker Street Research LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to the use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Bleecker Street Research LLC Related Person is defined as: Bleecker Street Research LLC and its affiliates and related parties, including, but not limited to, any principals, officers, directors, employees, members, clients, investors, Bleecker Street Research LLCs, and agents.