Atlas Lithium (ATLX): First Comes The Pump… Now Here Comes The Dump

Introduction: The Commodity Hype Cycle Comes For Lithium, Pretenders Latch On

Every few years, investors latch on to a new commodity. In the 2010's it was rare earth minerals, propelled higher by investors' beliefs that smartphones needed rare earth minerals. Conveniently but incorrectly named, rare earths turned out not to be neither rare nor required for iPhones. When that became apparent, many companies that latched on to the theme collapsed, leaving investors holding the bag.

This is a tale as old as time in the commodity sector. Something new comes along, which will need more of a particular commodity. There will invariably be companies that have done this for a while, but a host of small companies will try and glom on to the trend. Lately, that trend has been Lithium. As the story goes, Lithium will be needed in all electric vehicle batteries, and there will be a massive increase in demand soon.

This has propelled shares of many lithium mining companies much higher. Predictably, it has also created an opportunity for many hangers-on to latch onto this trend. We believe we have identified one such pretender in Atlas Lithium (ATLX). We are short shares of Atlas Lithium. We think it resembles many of the characteristics of a pump and dump. Ten years ago, its predecessor company did a similar promotion before bagging retail investors. Atlas Lithium's CEO was previously associated with Hunter Wise Securities, a broker fined $105 million for claiming to sell physical gold that it didn't have. Hunter Wise raised funds for Atlas Lithium (then called Brazil Minerals). A similarly disastrous bank handled ATLX's most recent offering and uplisting in early January. Retail investors have bit hook, line, and sinker for the story, professing their hopes for a future acquisition. We share the other side of the story below.

Atlas Lithium's CEO was previously a broker at a firm fined $105 million for misrepresenting that they had the physical gold they were selling.

At the same time that he was working there, he was the CEO of Brazil Minerals, which is the predecessor to Atlas Lithium. Brazil Minerals used an infamous and now-barred stock promoter to promote its stock, then quickly turned around and did an offering into this stock promotion.

Atlas Lithium's CEO did not disclose that he participated in this offering while working as a broker and was terminated in 2012, a year before the CFTC charges came down.

After years of (unprofitably) mining for gold and diamonds in Brazil, while their CEO lived in Beverly Hills, California, Brazil Minerals changed its name to Atlas Lithium and began to focus on lithium mining.

Atlas' "Proven or Inferred" Reserves are only 80,000 tons of Lithium Carbonate Equivalent (LCE), and they are contained in a formation that averages just 0.22% Li2O, well below the economic viability of 1%.

Atlas Lithium’s Previous Iteration Was A Pump And Dump Scheme That Ended With CEO Fogassa Fired

Before it was a lithium miner, Atlas Lithium was a diamond and gold miner known as Brazil Minerals. It was particularly good at either of those things, but that’s what it did. It came public via reverse merger and was almost immediately the subject of a stock promotion that ended in tears for investors that were promised Brazilian gold.

Atlas Lithium (then known as Brazil Minerals) went public via a reverse merger in 2011. Since its inception, it has been led by CEO Marc Fogassa. He remains the only person at the company that speaks Portuguese and maintains an office in Beverly Hills, California, where Atlas Lithium is headquartered.

Five months after it went public in 2013, Brazil Minerals became the subject of a $1.4 million budget hard mailer stock promotion, about as low-level as it gets. Stock promoter Tobin Smith was fired for getting paid to promote stocks on Fox News. Smith later settled SEC fraud charges for promoting a stock called IceWeb around the same time as the Brazil Minerals promotion.

In a hard mailer titled "Diamonds are an investor's best friend", Smith called for Brazil Minerals to go up to $18.90 per share over the long term. According to this article, the budget for this stock promotion was $1.6 million.

Just like the Atlas Lithium shareholders currently excited about the potential of a buyout, Brazil Minerals' shareholders were promised riches. Unfortunately, those riches never came, and Brazil Minerals' stock crashed 90% over the ensuing year after the stock promotion.

“Yesterday was the worst session yet for the much beleaguered Brazil Minerals, Inc (OTCBB: BMIX). The company has been on a downward slide since mid-May when they were trying to pass the 1 dollar mark. Investors are still trying to shed their holdings dumping 1 million shares on Monday. As a result, BMIX lost nearly a quarter of its value and dropped as low as $0.25. An hour before closing time, they managed to find some strength and finished at $0.29, 10 cents lower than they had opened.

The reason they were able to even reach the heights of last month in the first place was the start of a paid pump for the company. NBT Equities Research received $40 000 as compensation for their promotional efforts. They also took part in the pump for Western Graphite Inc. (OTCBB:WSGP) for the sum of $35 000. When the ticker crashed, it was so disastrous that we even did a video coverage about it.

But what lured investors in were the distributed hard mailers for BMIX that are still passed around. This time the budget was considerably higher, supposedly reaching $1.6 million. On May 20, the insiders decided the shares were at sufficient price levels and started dumping stock on the market, and haven't stopped since then."

While Brazil Minerals put out many press releases claiming to be on the verge of finding gold and also created a branded gold mold, shareholders were never compensated for such efforts.

Brazil Minerals generated just $1.4 million of revenue from 2013 to 2021 when it pivoted to a lithium play. It would lose $17.8 million over that time.

We think a similar future awaits Atlas Lithium shareholders in round 2 of the promotion.

Atlas Lithium Went Public Via An Offering Underwritten By A Fraudulent Broker, Where CEO Fogassa Worked

Fogossa has one of the most spectacular educational backgrounds one can have. Dual degrees from MIT, graduating from Harvard Medical School and Harvard Business School. (An academic track record so high quality and so normally unseen in the small and microcap CEO world that we had to check that he graduated from all three places - he did.)

Fogossa doesn't broadcast it now, but after Harvard Med and Business School, he entered the VC world. An early prospectus for Brazil Mining shows he invested in the VC world at Atlas Venture and Axiom Ventures. According to his bio, he previously worked at Goldman Sachs and Deloitte.

In January 2012, he joined Hunter Wise Securities as a stock broker. Hunter Wise Securities was a registered broker-dealer who also served as the private placement agent for a private placement around the reverse merger.

"Hunter Wise Securities, LLC ("Hunter Wise"), was the placement agent for the sale of 60,002 shares of Common Stock of the Company to 31 investors in December 2012. The company paid to Hunter Wise compensation, including cash, Common Stock and warrants to purchase Common Stock, in connection with Hunter Wise's services in such transaction. Marc Fogassa, the Chief Executive Officer of the Company, is a registered representative and a Managing Director of Hunter Wise, and received a portion of the compensation paid to Hunter Wise for such transaction."

Hunter Wise Securities was one of those firms you may remember if you found yourself in the unfortunate circumstance of watching a television commercial on Fox News or CNBC circa 2010.

Hunter Wise claimed to sell physical gold, silver, platinum, and copper, among other precious metals. Unlike those pesky ETFs, which weren't even backed by real gold, Hunter Wise had real gold. Well, as is usually the case in these kinds of things, not really. What Hunter Wise did have was a scheme.

Hunter Wise's scheme allowed people to buy physical gold at as little as 25% of the purchase price, with the remainder made up of an interest-bearing loan for the balance. To get buyers, Hunter Wise engaged with over 30 call centers, primarily based in Florida.

These types of pitches always set off our fraud alarms. And sure enough, Hunter Wise never actually had any physical gold - at all. Selling someone physical gold is illegal when you have no physical gold. Their marketing wasn't subtle. It directly claimed they were selling you physical gold. As the CFTC would show, Hunter Wise stole a lot of money from many people by creating a "rigged system."

This is where Marc Fogassa worked from January 2012 to January 2014. According to Finra BrokerCheck, Fogassa was terminated by Hunter Wise Securities for violating FINRA Rule 3040.

In May 2014, Hunter Wise was fined $108 million by the CFTC for these materially misleading statements, noting the fraud case was launched in 2012. Hunter Wise Securities acted as the placement agent and raised money for Brazil Minerals prior to its reverse merger.

Ultimately many investors suffered losses from Hunter Wise’s fraud scheme. Any Mention of Dr Fogassa's time at Hunter Wise Securities ended in 2017.

The playbook for Atlas Lithium is almost exactly the same as Brazil Minerals. With Brazil Minerals, there was a reverse merger, then stock promotion, and then came the dump. With Atlas Lithium, there was a name and business change and stock promotion. And we will have to wait and see if this time is different.

Why We Think Atlas Lithium Is Set Up For A Similarly Drastic Decline

Fogassa, after years of striking out in the precious metals sector, pivoted into Lithium in 2021. The company submitted an application with the Brazilian state mining agency in June 2021 to begin exploratory drilling. At this point, spot prices of Lithium Carbonate had nearly tripled from the 2020 Covid low of 37,000 RMB/ton to 108,000 RMB ($15,706)

Lithium plays in subsurface formations can share a lot of similarities with gold mining. Proven reserves with concrete surface and mineral rights are purchased by large companies at a premium and developed over years. However, marginal plays are cheaper because exploratory geology still needs to be completed, and the value of the minerals in the formation is unknown and wildly variable.

Small-cap gold mining stocks trade like lottery tickets because they are long-shot bets. These companies are not only a bet on the future value of the commodity itself being sufficiently high, but they're also a gamble that the miner with unknown or unexplored mining claims will, well, strike gold.

The top lithium stocks by market capitalization have seen their valuations soar in the past six months, spurred partly because of rumors that Elon Musk's Tesla intended to buy Brazil-based Sigma Lithium. Following a 2/17 report by Bloomberg regarding this rumor, Sigma (SGML) rose 20% to $35.56 within two days. Musk shot down the rumor as not true, which caused the equity to pull back some. It is currently trading at $40.

The most straightforward way to visualize this is by comparing the largest pure-play Lithium miners by Market Capitalization and total reserves of Lithium Carbonate equivalent (Which accounts for different grades, total tonnage and exclusivity of mineral rights), as shown below:

In corporate presentations, Atlas compares its reserves to peers in terms of Acreage:

Fellow Brazilian miner Sigma Resources, in contrast, provides unit economics for their reserves as follows:

So Why Doesn’t Atlas Lithium Share Their Reserves?

In our view, the simple answer to this is that management doesn't want to disclose the numbers. So we acquired records from Brazil's Government agency (ANM) that manages mineral rights.

As verified in government records, Atlas' only completed research confirms that mining rights associated with the company are only 85,370 tons of 6% CIF ore, with an additional inferred 170,740 tons possible.

Converting this to LCE (to match disclosures from industry peers) yields 38,000 tons. When visualized as a function of market capitalization, Atlas clearly stands out regarding overvaluation.

Fellow Brazilian Sigma miner is also broadly overpriced, in our view, compared with peers, especially given that many of its competitors have production in the US or Canada, instead of just Brazil, and have better access to end markets and Inflation Reduction Act (IRA) benefits.

However, Atlas' equity remains mind-boggling high when compared to peers, especially since their "Provable or Inferred '' asset base of 38,000 tons LCE is an estimate and may exist at concentrations well below economic viability, which we will cover below.

But What About The Drilling Results?

While Atlas management didn't feel the need to disclose Government assessments of their mineral base released in December of last year, they do love to issue press releases for a single promising drill bore. We think this reeks of desperation. Sigma and many other miners in Brazil have speculative mineral exploration permits. Sigma is spending millions on developing additional resources but also has a proven mineral base, along with a producing mine, mill and processing facility that is set to begin production this month.

In April, Atlas promoted single core samples containing lateral sections with concentrations of up to 4.4% Li2O. The individual core sample they decided was press release-worthy was described as containing “lithium mineralization intersects comprised a total of 43.61 meters, including a 25.43-meter interval with an average concentration of 1.44% Li2O.”

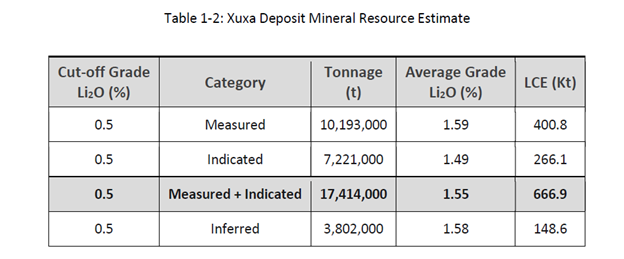

For context, Sigma Resources’ most valuable mine, also in the Mineas region of Brazil, has 17.4 million Measured and Inferred Tons of ore at an average 1.55% Li2O concentration across the entire formation.

In comparison, Atlas is issuing fawning press releases for a single borehole where only 58% of the spodumene sample's cross-section averages 1.44%. This implies that the "best core sample to date" is likely below 1% Li2O concentration. Atlas will need to complete dozens of additional holes to fully assess their vaunted Anitta pegmatite target on a formation basis. We think this is a game of roulette as to whether the formation will be economically viable.

In addition, Atlas’ March Press release announced a breakthrough in sample processing. CEO Fogassa beamed: “Our samples achieved commercial grade for use within established battery supply-chain processing routes.”

Oddly, the March press release speaks of "commercial grade" Lithium for automotive purposes but notably leaves out if the sample exceeded the 6% benchmark concentration. This is because lithium mines with ore that cannot be upgraded to the critical 6% threshold are functionally worthless, as the material cannot be used as a commodity in battery manufacturing.

Atlas Lithium Has Misrepresented The Nature of its Mineral Rights

We were struck by the language used by Atlas Lithium throughout investor communications and SEC filings. The company refers to "Mineral Rights" in a context that leads one to infer that these rights are immutable, transferable and, most importantly: a tangible asset held by the company. This couldn't be further from the truth.

In the United States, Mineral Rights are generally associated with ownership of the land containing minerals, oils or other natural resources. These rights are usually permanent, transferable and represent an effectively permanent claim on the rights to exploit the resources. Brazil does not operate under this framework. All mineral rights in the nation are considered owned by the government. Mineral extraction and processing occur via a licensure and royalty scheme.

The way it works is as follows: A company interested in exploiting mineral and resource development first applies for a license to explore the feasibility of extraction. This license is for a three-year term and is granted by the National Mining Agency (ANM) on an auction or bid basis. Following the license issuance, the interested company must propose a research plan to study the resource. This includes a budget and scope for exploratory drilling, geological surveys and economic and environmental studies. Once the research and exploration study is approved, the company must complete the study and submit results and an application to begin extraction.

The use of the land itself is an entirely separate issue, as landowners must negotiate with the mining company for surface rights following approval of the extraction.

Only after all of this is complete can actual mining begin. Again, the state owns the underlying mineral rights, and royalties must be paid in perpetuity to the Brazilian government. Only after reserves have been proven and Economic And Environmental Studies have been completed are the rights transferred to the company beyond the three-year research permit limit.

Atlas claims Lithium rights for two projects in Brazil: the Minas Gerais project and the Northeastern Brazil Project. A description of each from the company’s website is shown below.

The Minas Gerais project is the more developed of the two projects. They have numerous exploratory licenses and were granted approval to complete an initial exploratory survey/study that was completed in August of last year. Unfortunately, the economic prospects of proven reserves in this proposed mining site are essentially unworkable at this time, which we will flesh out further down on this report.

The Northeastern Brazil Project Research Permits expire in 2025. Given the capital costs needed to explore these regions and the time constraints before the land is put back up for auction or transfer by the state, we value these temporary “rights” at $0.

Atlas Lithium’s technical document on its primary Lithium Mine highlights financial unviability

The company applied for and was subsequently granted approval to complete a survey on the Minas Gerais play. The company proudly displays the technical report, completed in August of last year, on its website, but a closer look at the data further illustrates that this mine is likely worth very little.

On a basic level, 2.2 million tons of ore at an average concentration of 0.22% Li2O correlates to 80.66 ktons of 6% CIF ore and 12 ktons of LCE.

The government assessment uses a formula to determine inferred resources for surveys such as the one completed by the company. The inferred resources (170.74 kilo tons) is a simple 2x multiplier of the measured reserves (85.37 ktons)

The most accurate, up-to-date pricing for commodity lithium is the lithium spodumene 6% CIF benchmark of $3750/ton, meaning Atlas' estimated reserves' total sales value is $158 million.

We believe this number is misleading as a proxy for value for several reasons. First, the economically viable cutoff for other lithium mines in Brazil is for deposits over 1% Li2O average concentration, or about 5x more concentrated than Atlas' single estimated deposit. For example, Sigma, Atlas' neighbor in the Mineas region, has several deposits, with the largest containing over 28 million tons of ore at an average grade of 1.38%. Several of their deposits have an average concentration of around 1.5%

While Atlas’ report does indicate that some portions of the play contain sections with up to 3.5% Li2O, we estimate that this represents less than 6% of the ore present.

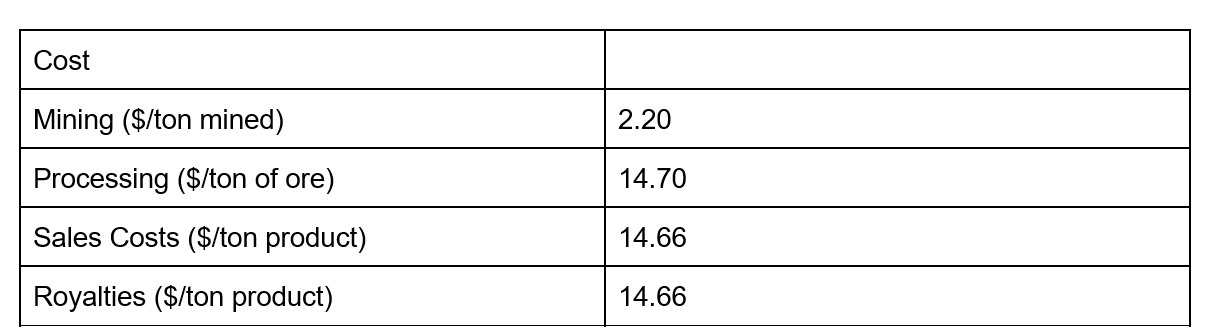

Sigma estimates in their complete technical report (approved by the Brazilian Mining agency) the following costs:

While Atlas’ report does indicate that some portions of the play contain sections with up to 3.5% Li2O, we estimate that this represents less than 6% of the ore present.

Sigma estimates in their complete technical report (approved by the Brazilian Mining agency) the following costs:

Assuming Atlas can meet these metrics, the following can be assumed:

The Brazilian Mining Agency requires an economic analysis, and the assumptions about end-market sales aren't at the company's sole discretion. Indeed, Sigma's approved plan in January 2023 required them to forecast spot price at $1,500/ton, 6% CIF, even though the price at the issuance was well north of $5000.

Based on the analysis provided, it isn't even clear if the Brazilian Mining Agency would approve Atlas' plan to mine based on the single completed research report. The project would have an expected -37% gross margin using these model inputs if the entire 0.22% play was mined. Therefore, we guess the agency would only approve a small (6% or so) of the ore for extraction, which would be only about $20 million in gross profits over several years.

It isn't an unreasonable expectation, therefore, to assume that a large portion of the formation in the survey region is simply unviable, logistically or economically. In addition, a section of core samples provided by the surveying firm indicates that only roughly 6% of drilled areas by depth yielded sufficient LiO2 concentrations of greater than 1.1%, which, again, is the minimum economic viability for Lithium mining based on current technology and market conditions.

These numbers are based on the completed survey. Using this as the sole benchmark places an extremely low expectation on capital return for equity holders.

But Atlas appears to be setting their sights on the exploratory work in progress on the Anitta pegmatite target as the narrative to excite investors, retail and institutional alike. It's a spin on the roulette wheel, and yesterday's deal announcement with Lithium Royalty Corp (TSX: LIRC) proves it.

A 3% Gross Overriding Royalty is a Bad Deal for Atlas Shareholders

Lithium Royalty Corp handed Atlas a check for $20 million in exchange for perpetual 3% royalty on all minerals extracted from Atlas's leased mineral rights in the region. This deal, announced on Tuesday, excited investors as a potentially dilutive equity financing round appeared off the table for now.

But a quick look at LRC's portfolio shows that the investing firm's excitement for the project may not be as robust as ATLX investors assumed. Every ongoing royalty deal on LRC's books in South America, North America and Australia is priced at 1.5% or lower. Most of these deals, including the royalty arrangement with Atlas’ Brazilian neighbor, Sigma, are priced at 1% GOR. The GOR scheme is a feature of Canadian mining ventures, which have become somewhat notorious for being home to numerous scams and shady deals. The GOR acts as a semi-permanent liability against the assets of the mine, including rights and mining equipment. While there is no bond coupon to pay or new shares to issue, the GOR cuts the top and bottom line profits by 300 basis points for the life of the royalties.

If Atlas can get its 150 kton/year processing plant up and running, LRC will yield up to $18 million in royalties per year at current market prices. Therefore we do not see LRCs $20 million investment as faith that the mine will become a reality under Atlas's existing corporate structure. Instead, it is a call option that will yield up to 90% annual returns. LRC is playing a game of high-risk, high-yield portfolio management. Because Atlas shareholders are the last to get paid on returned capital, we see them as gamblers.

Conclusion

EF Hutton’s second round of stock promotion looks a little different than the first round, but we think the result will be the same. Instead of Hunter Wise in 2013, they have EF Hutton now, who raised money for the company before its January uplisting. EF Hutton IPO’s and deals have followed a remarkably similar trajectory. A low-float stock goes public, stock promotion happens, and then they tank. We have seen it play out many times over the last several years, and have written about several of these names.

Atlas Lithium is set up to massively disappoint the retail investors that have bought into this story. We see little likelihood that Atlas Lithium will get acquired. It is trading at a massive premium to other lithium miners, and what little Lithium it does have in Brazil is low-grade. As a result, we see substantial downside in the stock. Atlas Lithium is one of the most overvalued lithium miners in the world, and that has come in part because of an effective promotion organized by small banks. Yesterday was just the beginning of a long downward spiral for Atlas Lithium shares.

Bleecker Street Research LLC Terms and Conditions

By downloading from or viewing material on this website you agree to the following Terms of Service. Use of Bleecker Street Research LLC’s research is at your own risk. In no event should Bleecker Street Research LLC or any Bleecker Street Research LLC Related Person (as defined hereunder) be liable for any direct or indirect trading losses caused by any information on this site. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities of an issuer covered herein (a “Covered Issuer”).

As of the publication date of Bleecker Street Research LLC’S report, Bleecker Street Research LLC Related Persons (along with or through its members, partners, affiliates, employees, and/or Bleecker Street Research LLCs), clients, and investors, and/or their clients and investors have a short position in the securities of a Covered Issuer (and options, swaps, and other derivatives related to these securities), and therefore will realize significant gains in the event that the prices of a Covered Issuer’s securities decline. Bleecker Street Research LLC and Bleecker Street Research LLC Related Persons are likely to continue to transact in Covered Issuers’ securities for an indefinite period after an initial report on a Covered Issuer, and such position(s) may be long, short, or neutral at any time hereafter regardless of their initial position(s) and views as stated in the Bleecker Street Research LLC’S research. One or more Bleecker Street Research LLC Related Persons have provided Bleecker Street Research LLC with publicly available information that Bleecker Street Research LLC has included in this report, following Bleecker Street Research LLC’S independent due diligence.

Research is not investment advice nor a recommendation or solicitation to buy securities. To the best of Bleecker Street Research LLC’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the securities of a Covered Issuer or who may otherwise owe any fiduciary duty or duty of confidentiality to the Covered Issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Bleecker Street Research LLC makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Research may contain forward-looking statements, estimates, projections, and opinions with respect to among other things, certain accounting, legal, and regulatory issues the issuer faces and the potential impact of those issues on its future business, financial condition, and results of operations, as well as more generally, the issuer’s anticipated operating performance, access to capital markets, market conditions, assets, and liabilities. Such statements, estimates, projections, and opinions may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Bleecker Street Research LLC’s control. All expressions of opinion are subject to change without notice, and Bleecker Street Research LLC does not undertake to update or supplement this report or any of the information contained herein. You agree that the information on this website is copyrighted, and you, therefore, agree not to distribute this information (whether the downloaded file, copies/images/reproductions, or the link to these files) in any manner other than by providing the following link: Bleecker Street Research LLC bleeckerstreetresearch.com The failure of Bleecker Street Research LLC to exercise or enforce any right or provision of these Terms of Service shall not constitute a waiver of this right or provision. If any provision of these Terms of Service is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties intentions as reflected in the provision and rule that the other provisions of these Terms of Service remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to the use of this website or the material herein must be filed within one (1) year after such claim or cause of action arose or be forever barred.

Bleecker Street Research LLC Related Person is defined as: Bleecker Street Research LLC and its affiliates and related parties, including, but not limited to, any principals, officers, directors, employees, members, clients, investors, Bleecker Street Research LLCs, and agents.