Alfi (ALF): Miami’s First Tech IPO Is Quintessential Florida; An Ad-Tech Company With A Questionable C-Suite, “Continuing” Buy-Backs, And Relying On A Laser Engraving Company For Distribution.

Disclosure: Bleecker Street Research is short shares of ALF.

Introduction

Alfi, Inc. (NASDAQ: ALFI) is a $140 million advertising technology company that seems to have thrown nearly every buzzword at the wall to see what sticks. Among Alfi’s claims are that they are using:

AI and Machine Learning

Big Data

SaaS

Computer Vision

Recommendation Engine

IoT Cloud

Interaction services

Alfi was conceptualized in 2016, and the company was founded in 2018. In 2019 CEO and founder Paul Pereira tweeted that Alfi was a:

“Interactive, intelligent, digital media tablet that senses human behaviour using machine learning with computer vision and publishes on a new media platform specifically curated content for the demographic and psychographic of the user.”

Armed with 20,000 Lenovo tablets, which cost $100 apiece, Alfi has claimed to redefine the digital out of home (“DOOH”) advertising market by “facially fingerprinting” users with the equivalent of an iPhone 4 camera to show them relevant ads based on determinations Alfi can make about their “age, gender, ethnicity, and geolocation information.”

We don’t believe any of those buzzwords, and we believe Alfi has misrepresented its business model to investors or customers. Alfi’s model is to give the Lenovo tablet to Uber or Lyft drivers, and let the rideshare drivers will get a cut of the advertising revenue generated by engagement. We believe Alfi has misrepresented their model to customers or users, when we called several of the early adopters of the technology, they made claims contradictory to Alfi’s claims.

In court filings Danimer accused him of using company funds for personal use, paying for international trips for his son and a friend, and “repeatedly engaging in self-dealing” including using his wife’s graphic design firm to siphon money out of the company. Danimer also accused him of

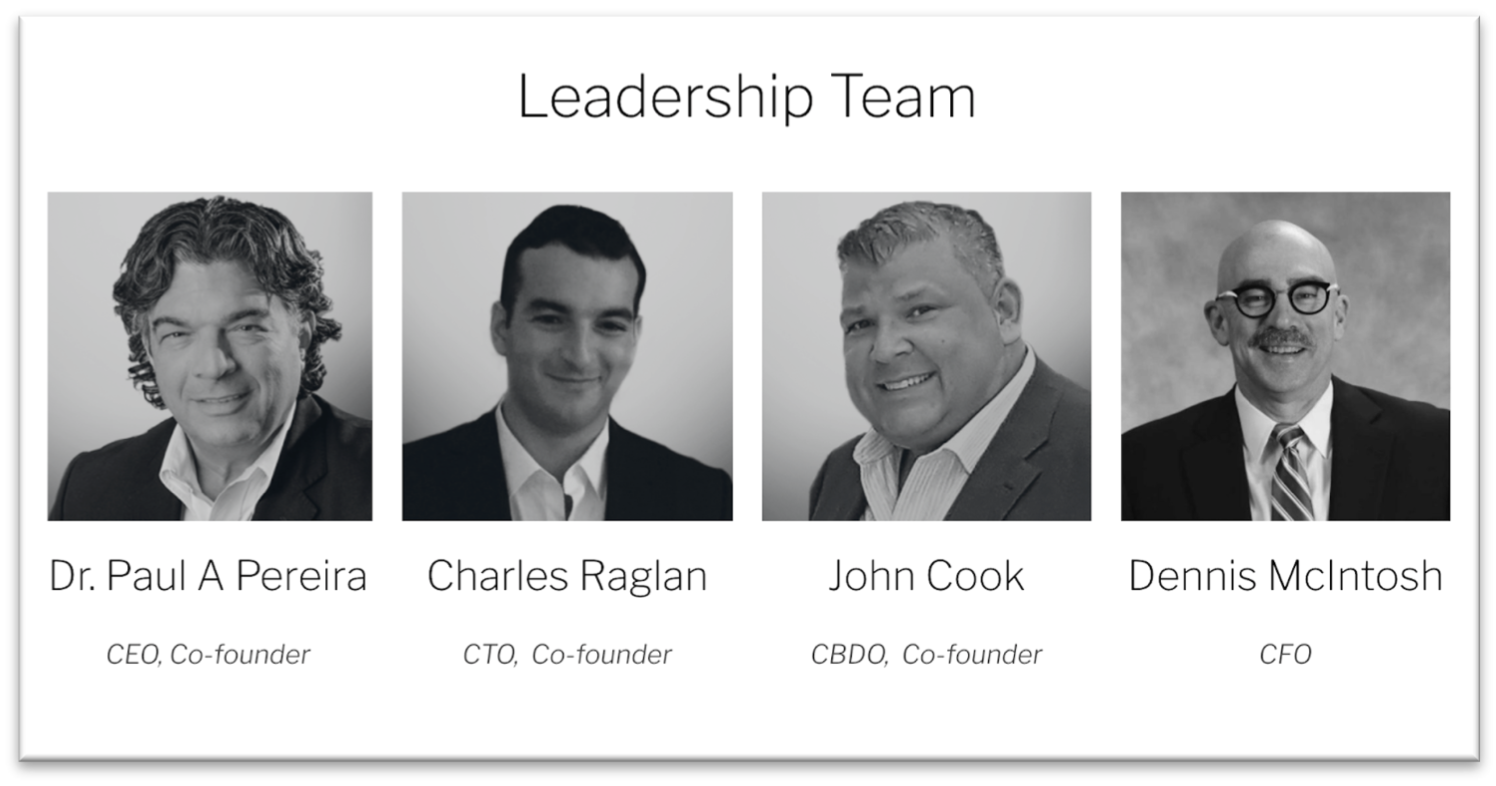

consistently missing meetings and/or showing up to them and/or “becoming grossly inebriated.” Alfi’s chief technology officer is the son of the CEO, something which they have hidden by changing his name on their website. The third co-founder, John Cook, was previously charged for his role in a Florida stock fraud in the early 2000’s. Cook was later arrested and criminally charged in the case.

In terms of the business, Alfi has announced vague and nebulous partnerships, and when we contacted these partners almost all of them contradicted Alfi’s claims. At the end of 2020, Alfi was burning $200,000 a month and had just $8,300 left in the bank. It had never generated any revenue and was in a dire financial position. Just seven days into the new year, Alfi would begin its IPO process. In May, the company would go public, its stock quickly rising 235% into its current $140 million valuation.

This was driven by various bullish announcements of new partners and the roll-out beginning, as well as the announcement of a $2 million buyback less than a month after the IPO. Alfi’s stock rose 50% the day of the buyback announcement, in which Pereira called shares “undervalued” and said that they would “continue to buy back our stock.” Continue implies something that is happening, and words do matter.

Alfi’s Founder and CEO Has Extensive Litigation With A Previous Employer That Accused Him Of Lying About His Educational Credentials As Well As Exaggerating Company Financial Performance And A History of Alleged Self-Dealing

Paul Pereira’s bio lists extensive private company experience, but none of them stick out more than his time at Danimer Scientific. Alfi’s SEC filings paint a rosy picture of his time at Danimer:

“From August 2013 to November 2015, Dr. Pereira also served as the Chief Executive Officer and Executive Chairman of MHG (Danimer Scientific) where he spearheaded a turnaround from bankruptcy to a multi-million buyout offer in two years which eventually ended up with a SPAC acquisition on NYSE (DNMR) in December 2020 at an enterprise valuation of $890 million.”

But extensive litigation from the company paints a much different picture. In this picture, Pereira was allegedly showing up to meetings drunk, misrepresenting the company to investors, and siphoning money out of the company, including spending on international trips for his son and son’s friend.

We note these are allegations that Pereira has disagreed with publicly and in court filings. His side of the story can be read about here.

But according to legal filings, the turnaround never happened. Instead, the company accused Pereira of a series of misdeeds. We again note these are accusations, ones with which Pereira did not agree. We would also note that Pereira admitted on the stand to falsifying his resume and lying about his educational background. From the lawsuit:

“Repeatedly altered and misrepresented Meredian’s projections and other company information in presentations and communications to potential customers and/or investors in order to obtain their business under false pretenses.”

“Repeatedly and purposefully disclosed confidential information of customers and/or potential customers in press releases and presentations.”

“Repeatedly used Meridian funds to reimburse himself and/or the Alton Companies for personal and non-business-related expenses by misrepresenting that expense requests were for business purposes. These included, without limitation, travel expenses for Pereira and hiswife that were not business-related, dry cleaning services, dining expenses, boat fuel, and fishing equipment.”

“Repeatedly wasted company money on non-essential and useless endeavors, including establishing an office in Miami, Florida (which was used by Pereira and/or the Alton Companies for non-Meridian business), hiring personal friends who lacked any relevant experience and brought no value to Meridian, paying for trips abroad for his son and his son’s friend, and retaining a marketing firm at an exorbitant rate whose primary purpose was to promote Pereira and/or the Alton Companies, rather than Meridian. As a result, Meridian was unable to purchase raw materials, equipment, and safety items necessary to operate its core business.”

“Repeatedly engaged in self-dealing, including retaining and causing substantial feeds to be paid to the House of Miami, a company owned and controlled by Pereira and his wife, for graphic design services that were unnecessary and/or exorbitant, and the fees for which went directly to Pereira and his wife.”

“Repeatedly failing to show up for meetings with potential and current customers and/or investors and/or showing up and/or becoming grossly inebriated.”

“Repeatedly threatening, without basis, to terminate Meridian’s executive team when they sought to question his conduct and thereby fomenting disruption, turmoil, and uncertainty in the workplace.

CEO of Alfi: Said One Thing Publicly At The Time, Another Thing Later In Court

The press release announcing Pereira’s hiring opened by saying that Meridian (now Danimer) was “on the brink of a significant expansion.”

“Merdian Inc., MGH, leading biopolymer manufacturer, is on the brink of a significant expansion… Paul Pereira has been appointed as CEO… and will continue to drive the company to global prominence.”

Yet court filings and Pereira’s own testimony show that at the same time they were touting the company as “on the brink of a significant expansion,” Danimer was experiencing financial difficulties and that Pereira was brought in to orchestrate a turnaround.

From Danimer’s complaint:

We think this discrepancy in public statements when compared to what was happening is something Alfi shareholders should be cognizant of when evaluating the claims Pereira makes about Alfi.

We note these are merely accusations, and Pereira and Danimer settled the lawsuit before Danimer eventually went public through the SPAC in 2020. But the track record is troubling, including what Pereira has admitted to, is extremely troubling, especially when viewed in light of some of Pereira’s claims about Alfi.

One amusing story came out of the trial when the plaintiff’s counsel told the following story about Pereira’s actions during an attempted mediation before the case went to trial. The issue was the legitimacy of Pereira’s ownership, and thus, his ability to sell the shares.

“As the court is aware, there was a mediation in the case that took place in April over the course of two days. The parties and Mr. Pereira and his counsel and Mr. Croskrey, who is sitting here today, and his counsel all flew up to New York in a good faith attempt to try and negotiate a settlement of the case. And during the time that the parties were negotiating the mediation, Mr. Pereira posted a message on the plaintiff’s own Facebook page. The page is available to the public, and the post he made said the following: “Danimer Scientific’s “MGH Holdings” largest shareholder puts up 20% stake in the company for sale on Wall Street, which was misspelled as Was Street in the post. And it goes on to say: After two years of litigation with Danimer Scientific and counter lawsuits, today Pereira decided that his 20% ownership of non-dilutive shares are for sale. There have been many inquiries, however, any inquiries can contact Pereira directly.”

A few days later, Pereira would put out a press release saying the same thing.

Alfi’s Chief Business Development Officer And Co-Founder Has Been Barred By FINRA And Was Charged By The SEC For A Florida Stock Fraud

In 2001 the Securities and Exchange Commission charged John Cook and three others for their role in a fraudulent stock offering that raised $15.5 million for a company called Link Express Delivery Solutions. The SEC alleged that Cook, along with others, “provided investors and potential investors with false and misleading offering documents and made material misrepresentations and omissions to investors concerning the use of investor funds, Link’s projected revenues and anticipated returns.”

“Link projected sales of over $1.6 million when it began operations. Link’s revenues, however, did not meet those projections. In fact, Link’s total revenues were only $752,862, of which it collected only $254,000. Nonetheless, Link’s offering materials, which were distributed to prospective and actual investors, continued to state that Link would earn extraordinary revenues in excess of $14.8 million.”

Stock was offered through Argus Securities, which was supposedly owned by Cook. In fact, another defendant controlled the broker-dealer. The SEC alleged that “Johnson used Cook and Argus to support a fiction of broker independence, and to promote an image that Link securities were a viable investment.” The jury in the SEC case found Cook not guilty, but Cook was later criminally charged along with Paul R. Johnson in the same matter.

FINRA would bar Cook in 2002.

Alfi Appears To Be Covering Up The Fact That Their Chief Technology Officer Is The Son Of Paul Pereira

Alfi co-founders are the father-son duo of Dr. Paul Pereira and son Charles Pereira, with John Cook rounding out the founding team. Alfi’s SEC filings disclose the father-son relationship. Alfi’s website covers it up.

Alfi claims to have created a tech-enabled interactive advertising platform. Alfi claims to “facially fingerprint” people with a camera embedded in a Lenovo tablet with this platform and technology. They will then determine “age, gender, ethnicity and geolocation information,” which will allow Alfi to serve targeted ads. The ads are interactive so that Alfi can track click-through rates. CEO Paul Pereira described the technology in a recent interview.

“Imagine with me that you are a 25-year-old female wearing Gucci sunglasses and you’re walking through an airport, and the content of every ad is specifically curated for you. So instead of seeing ads for retirement homes or ads for wheelchairs – which are not really relevant to you as a 25-year-old female – instead what you’re seeing are lady’s fashionable wear and designer sunglasses specifically curated for you.”

Interesting.

In addition to rideshares, Alfi has discussed placing its tablets in malls and other high-traffic areas.

Currently, Alfi has about 9,600 of the Lenovo tablets setup with their software, and have announced the purchase of 10,000 more tablets. Alfi has guided to having 150,000 tablets in circulation by the end of 2022 and $100 million of advertising inventory on the platform by the end of 2021. We think that number is exceptionally aggressive. So far, the only company Alfi has announced an advertising deal with is a small CBD company that went public in June with the same underwriter as Alfi.

Alfi’s Partnerships Raise More Question Than Answers: Is Alfi Really Doing What They Say?

Beyond the announcements of advertising supply on their platform, Alfi’s has announced several “strategic” partnerships for the roll-out of their tablets.

In early June, Alfi announced that they had resumed the roll-out (words do matter) with a Belfast-based cab company called Value Cabs. The press release claimed that Value Cabs was operating over 800 vehicles before the pandemic, making it “Northern Ireland’s number one taxi and chauffer-driven company in the region.”

We decided to give Value Cabs a phone call. They told us that they did have the tablets but were “literally just advertisements on a screen” and “displaying the same advertisements to all customers.”

When we asked about the cameras, the operator was adamant they were not scanning customers’ faces or utilizing any camera of any kind.

A few days after the Value Cabs announcement, Alfi announced that it had executed a contract and commenced operating its digital advertising technology in multiple kiosks located within Hammersmith Broadway Shopping Centre in London.

We gave Hammersmith Broadway a phone call. Like Value Cabs, the operator acknowledged the presence of Alfi’s devices and conveyed the utmost certainty that the devices were not scanning customers’ faces or utilizing a camera of any kind.

Based on these conversations, it seems a clear pattern of denial of the existence of any cameras on the devices. We believe this indicates one of the following theories:

Alfi has failed to adequately disclose to their clientele that their tablets utilize cameras to analyze customers’ faces.

Alfi’s claims of utilizing proprietary “facial fingerprinting” and “computer vision” are hot air, and the role the cameras and AI play are much more limited in reality.

Employees of Alfi’s clients are unaware of cameras and data capturing.

In a recent interview, Pereira lampooned the DOOH market for “lacking transparency and accountability” and touted Alfi for being “a platform capable of delivering relevant content in an ethical and respectful manner.” However, we believe that if Alfi were actually in that business, they would adequately disclose to customers and clientele what is being tracked. Indeed, nowhere in Alfi’s materials for drivers do they say they are tracking the rider.

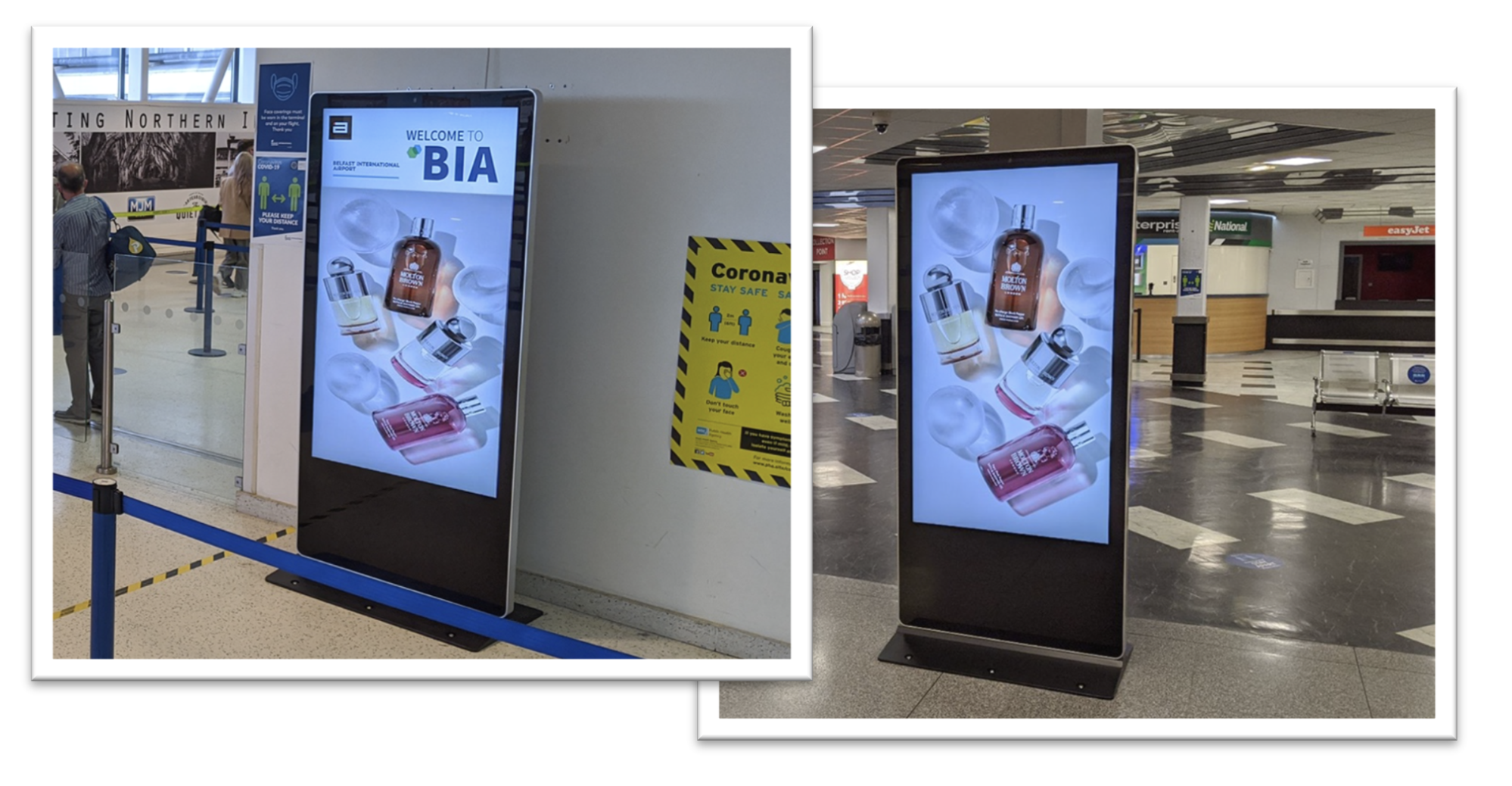

Some Alfi devices that have been placed have little to no identifiable information linking them to Alfi. For example, the images below are two Alfi kiosks erected in Belfast International Airport. Neither one of them has any disclosure that a camera is being used or that customers’ demographics are being collected. One of the tablets doesn’t even have a logo or seemingly any identifying information linking it to Alfi. The other simply has an “A” at the top of the screen.

On August 17, Alfi put out a press release announcing several pieces of news that drove the stock up 50% that day. According to the press release, 30,000 rideshare drivers have subscribed for tablet installation across the United States. These tablets will be shipped for free, and the drivers will be paid a monthly commission on advertising metrics. Alfi’s stock

In the release, Alfi guided to $100 million of advertising inventory available on their platform by the end of this year, and that it expected to deploy 150,000 Lenovo tablets by the end of 2022.

We are 75% of the way through the year and Alfi has only announced one advertising campaign, we wonder how realistic that $100 million number is.

Alfi has announced one advertising campaign with a CBD pre-roll company called Grove, Inc. The press release announcing that deal came on August 18 with the announcement saying Alfi and Grove had partnered to “launch a campaign aimed at building consumer awareness of Grove’s Cannabidiol (“CBD”) products for the botanical, beauty care, pet care, and functional foods sector.”

Grove’s CEO would comment on the potential size of the partnership: “We hope this turns into a multi-million partnership with Alfi.” Multi-million would, at minimum, mean $2 million in our mind. That would make up about 20% of the $11 million that Grove Inc. raised when they went public in June of this year, in an IPO also led by EF Hutton.

While Alfi touts itself as redefining the digital out of home advertising market, they seem to just be copying others that have been doing this for longer and with more funding and customers.

We Believe Alfi’s Business Model, Corporate Strategy, and Product All Pose Significant Concerns

With an estimated $165 billion invested in 2020, venture capitalists have been happy to throw money at everything from burger-flipping robots, to lab-grown meat, to luxury clothing rentals. We believe that Alfi’s inability to raise private funding speaks volumes about the legitimacy and viability of its business and product.

We believe that Alfi’s product offering lacks any significant competitive advantage and barrier to entry. We found a plethora of businesses with similar offerings to Alfi including Cooler Screens, Five Tier, Quividi, and Octopus. Unlike Alfi, these businesses have expansive customer bases with recognizable names including Walgreens, 7-Eleven, Vodafone, Barclays, Marriott, and thousands more. Alfi, on the other hand, has relied on small partnerships with random airports and malls.

Alfi’s Technology Is Not New

Alfi’s product and technology are certainly nothing new. We found numerous articles dating back to 2008 discussing various forms of “DOOH” advertising. Many of these articles conveyed a negative sentiment towards demographic targeting. Many of these articles also expressed privacy concerns from customers. One article from New York Times in 2008 quoted a user as saying “That’s disturbing. I would say it’s arguably an invasion of one’s

privacy. I guess one would expect that if you go into a closed store, it’s very likely you would be under surveillance, but out here on the street? I guess that’s kind of creepy.”

We believe the DOOH market, especially that which seeks to try to provide targeted ads based on the customer, has been saturated.

Slack & Company CPAs, Alfi’s Auditor, Have Had Some Rotten Clientele

In June 2021, Arizona state regulators ordered Charles O’Dowd, a principal shareholder and officer of ABCO Energy Inc., to pay $7.7 million in restitution and penalties for fraudulently offering and selling unregistered securities to 81 foreign investors.

ABCO had sought fundraising under the guise of growing their business by hiring a sales and marketing team. In reality, O’Dowd and ABCO used 65% of the funds raised to pay off a company based in the United Kingdom and/or Spain to illegally illicit foreign investors.

The rest of the company’s Slack & Co. audits are also unimpressive.

There’s Quad M Solutions, which used to be looking for gold and copper and is now offering employee benefit and consulting services. Quad M Solutions currently has a $6 million market cap.

And GEX Consulting, a former back-office support company that pivoted to staffing tech consultants. Gex Consulting currently has a $4.5 million market cap.

There’s Green Stream Holdings, which is trying to install solar panels in high-density urban areas. So far, it has not generated any revenue and, as of January 31, 2021, had $5,806 in cash.

Finally, there is Greene Concepts (OTC: INKW), an “enhanced beverage” company selling a branded bottled water called “Be Water,” which lists “intent to participate in the 22 billion dollar beverage industry while leveraging hemp” as one of their key projects.

One unrelated to Alfi item is interesting: OTC Markets lists James DiPrima as the accounting and audit contact for Greene Concepts, but DiPrima also serves as the CEO of Green Stream Holdings.

The Bank Responsible for Alfi’s IPO Has Seen Their Average IPO Fall 31% Right Out Of The Gate, Alfi Is The Only Outlier

The investment bank that saw a company with no revenue and $8,300 in cash in the bank burning $200,000 a month and thought, “this should be a public company” has a track record of bringing companies public that immediately fall. While Alfi has proved an exception so far, we don’t expect that to last.

Alfi began its IPO process with a bank called Kingswood Capital Markets, which has since changed its name to EF Hutton, which we will use from here on out. In recent press releases EF Hutton, which was founded in May 2020, claims to have raised over $3 billion for companies over the last twelve months. But the performance of IPOs where EF Hutton has served as the lead book-runner on paints a picture of a lot of companies that have quickly risen and then fallen.

Alfi’s Definition of “Strategic Partnership” Is Uh, Confusing, To Say the Least

Perhaps in an effort to legitimize itself, Alfi has listed about a dozen “strategic partners” on their website. These logos seem more like entities Alfi has engaged in over the course of doing business. Kind of like if we claimed Apple was a strategic partner because this was written on a Macbook. But we don’t do that because we’re not like Alfi.

Alfi lists AWS Activate, Nvidia, AT&T, Lenovo, Esper, Gunderson Dettmer, California Counsel Group, and Atlassian all as strategic partners. They simply purchased the tablets from Lenovo, paying full retail, so we would hardly call them a strategic partner. Gunderson Dettmer and California Counsel Group are law firms, albeit not mentioned in Alfi’s filings.

Alfi’s Offices Are Like Their “Strategic Partners”

Much like their reliance on logos from well-known companies which could suggest buy-in from reputable companies, Alfi’s website seems to suggest there’s an international presence. In fact, Alfi’s headquarters are in the Miami WeWork, as are their Denver offices.

Their headquarters are located at 429 Lenox Avenue, Suite 547, Miami Beach, Florida 33239. That is the location of the Miami WeWork.

Alfi’s Denver office is located at 1550 Wewatta Street, Suite 2172, Denver, Colorado 80202. Also, the location of the Denver WeWork. We think this makes Alfi the first public company headquartered out of a WeWork.

Despite Saying They Were Continuing To Buy-Back Shares, Alfi Had Yet To Buy-Back Any Shares

In a puzzling move, Alfi announced a $2 million share buyback a little over a month after its IPO. Why would you sell shares to the market in May, raise $15.5 million, and then a month later announce a $2 million buyback? In the press release announcing the buyback, Pereira said that “our conviction in our future prospects makes this an appropriate time to repurchase stock and return capital to stock holders.” The same day Pereira was quoted as saying “we will continue to buy back our stock as a firm commitment to our company valuation.” Again, words do matter. By saying continue the implication is that a buyback had happened. Yet their 10-Q for Q2’21 revealed that Alfi had not repurchased any shares by the end of the second quarter.

Pereira was quoted in the 8-K as saying Alfi’s stock is “undervalued based on pipeline projections and identified opportunities.”

Alfi’s Distribution Partner For Their Tablets Is A Miami Laser Engraving Company

In yet another partner-related head-scratching move, Alfi has engaged “All-Niter” to handle the “fulfillment, staging, and shipment of their first 10,000 tablets to Uber and Lyft drivers nationwide.” The press release quotes an All-Niter VP as saying, “We invested into Alfi before we even thought we had an opportunity of working with them. When I saw the technology, I was blown away that this was already here and running. My whole family invested in the IPO. This technology platform is disruptive and revolutionary. We want to be a part of it.”

Another employee of All-Niter was quoted as saying “This is only the beginning. We are going to light up every major city in the USA. There is no other choice when it comes to accurate brand targeting and real data reporting. Nobody does this while remaining privacy compliant. We have a massive operation unfolding in Miami today with hundreds of Ubers and Lyfts installing Alfi tablets. It’s an epic event and marks the start of our nationwide roll-out.”

All-Niter is a laser engraving shop in Miami, so we wonder about the qualifications of the company to handle this nationwide roll-out.

A search on LinkedIn for All-Niter reveals only one employee. A search for “Niter Miami” reveals three people.

All-Niter lists a section for past projects on their website, which directs you to All-Niter’s Instagram. Some projects they have done recently include: engraved cannabis grinders, a custom engraved gun, and a handful of custom engraved cutting boards.

Perhaps because of this, Alfi announced that All-Niter was expanding last week. According to the press release they have purchased 48 new 3-D printers and added 5,000 square feet of fabrication and staging space, and added 8 new employees.

Alfi’s Financials Paint A Grim Picture

While it is early in the roll-out of their product, the financials paint a grim picture. In Q1’21, Alfi generated $17,450 in revenue, which led to a $3.5 million net loss. In Q2’21 Alfi generated a measly $936 in revenue, losing $6 million in the process.

Despite this, they have spent $9.8 million in general and administrative expenses and $6.7 million in stock-based compensation since inception. Alfi currently has $19.6 million in cash on its balance sheet.

Conclusion

Given the aforementioned issues with the Alfi C-Suite, Bleecker Street Research believes that shares deserve to be trading much lower. Technology like that of Alfi’s has been around for over a decade. Alfi is relying on a laser engraving company that showcases guns, cutting boards, and marijuana grinders among their recent projects for their distribution

Alfi has generated some buzz as apparently being the first of the new-wave of Miami tech companies to IPO. For those not aware, Miami has become something of a tech hub during the pandemic, with numerous VC’s fleeing San Francisco for the warm weather and low-taxes of South Florida. But Miami is a perilous city, one that is literally crumbling under the impact of global warming and too much cocaine. It is a rented Lamborghini, a fake chain. We expect that Alfi shareholders will end up just like Miami, underwater.